Smart Check – Automatic Reverification

The process is fully digital and guided: forms are completed online, information is automatically validated, and merchants can track their reverification status in real time—without manual management or additional support.

Main benefit: merchants keep their accounts active and compliant without interruptions through a secure, simple, and automated flow.

How Smart Check Works

The reverification process consists of four main stages, all managed from the Merchant Panel.

The following video demonstrates the complete process. This section also provides a brief description of each stage.

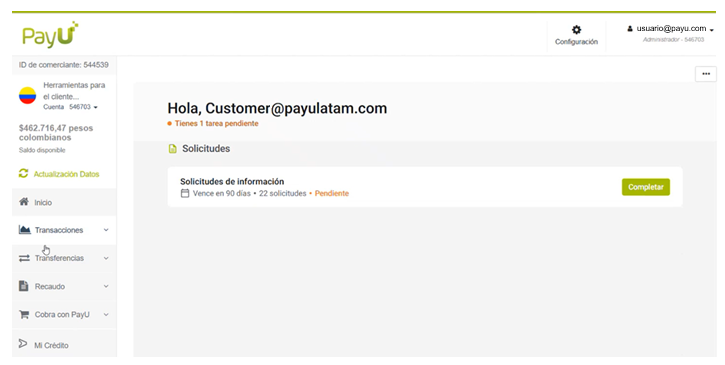

1. Accessing the Process

When a merchant needs to update their information, the Data Update option becomes available in the left-hand menu of the Merchant Panel. Upon entering, all required forms are displayed according to the merchant type (individual or legal entity).

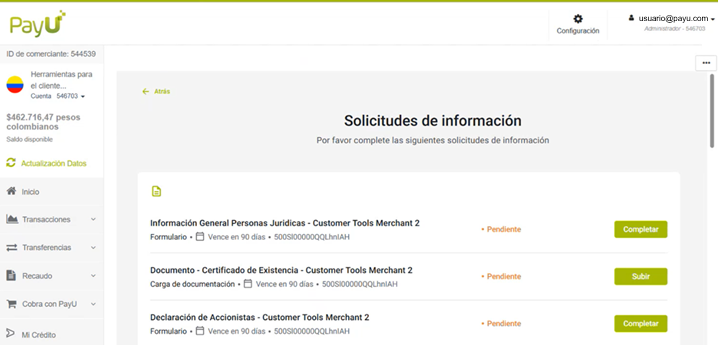

2. Completing the Forms

The forms are designed to make the update process straightforward. Each one includes preloaded information with the merchant’s current data, along with fields that need to be reviewed, updated, or completed.

The main forms include:

- General information: legal name, address, contact details, and business activity.

- Certificate of existence and legal representation: updated document issued within the last 3 months.

- Business details: description of the business model, supplier controls, and compliance policies.

- Financial statements: last two fiscal years.

- Ultimate beneficiaries and directors: ownership and control information.

- Declaration of source of funds: confirmation of the lawful origin of resources.

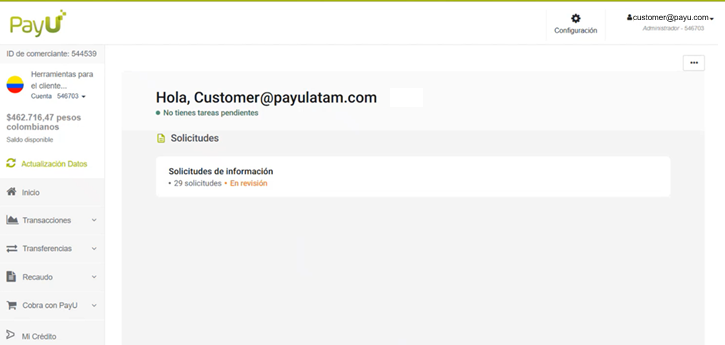

3. Submission and Validation

Once all forms are completed, the system runs automatic validations to verify the consistency and authenticity of the information:

- Document review: automatic verification of certificates and financial statements.

- Identity and OCR validation: automatic reading of attached documents.

- AML/KYC checks: screening for PEPs, sanctions, or adverse media.

- Risk analysis: the system evaluates the information to determine the merchant’s risk level.

During this stage, the process status appears as Under review in the panel.

4. Process Outcome

- ✅ Approved: the system automatically closes the process and updates the merchant’s information.

- ⚠️ Additional review: if the PayU team identifies any inconsistencies, they will contact the merchant to complete or attach additional information.

Benefits for Merchants

- Full autonomy: merchants can update their information directly without relying on PayU support.

- Automated compliance: PayU ensures regulatory compliance through automated validations.

- Enhanced traceability: all information remains securely stored and traceable within the system.

- Guaranteed operational continuity:

- Merchant Panel features remain available as long as the merchant completes the forms within the established timeframe.

- If the merchant already has active restrictions, they are automatically lifted once all forms are submitted—no need to wait for PayU’s final approval.

- If additional documentation or clarification is needed during the review, PayU will contact the merchant directly to complete the information without affecting operations or panel availability.

Process Statuses Displayed

During reverification, merchants can view the following statuses in the Merchant Panel:

| Status | Description |

|---|---|

| Pending completion | The form is available and awaiting completion. |

| In progress | The forms have been submitted and automatic validations are in progress. |

| Approved | The information has been successfully validated and no further actions are required. |

| Under review | PayU is reviewing additional information. |

| Expired | The merchant did not complete the process within the established timeframe. |

Additional Considerations

- The reverification process is automatically enabled according to PayU’s defined periodicity.

- Merchants have up to 80 days to complete all information.

- Documents must be uploaded in PDF format, readable, and without passwords.

- If the process is not completed within the timeframe, Merchant Panel functionalities may be temporarily limited.

- Once the process is approved, the merchant can continue operating as normal.