Payments API - Colombia

This guide shows how to leverage these services to enhance your customers’ payment experience by providing flexible and secure payment options tailored to the local market.

Note

To integrate with the Payments API, direct your requests to the following URLs based on the corresponding environment:

- Test:

https://sandbox.api.payulatam.com/payments-api/4.0/service.cgi - Production:

https://api.payulatam.com/payments-api/4.0/service.cgi

Available Features

Payments API includes the following features:

- Submit Transactions Using Credit or Debit Cards

- Submit Transactions Using Bre-B QR

- Submit Transactions Using Bank Transfer (PSE)

- Submit Transactions Using Google Pay

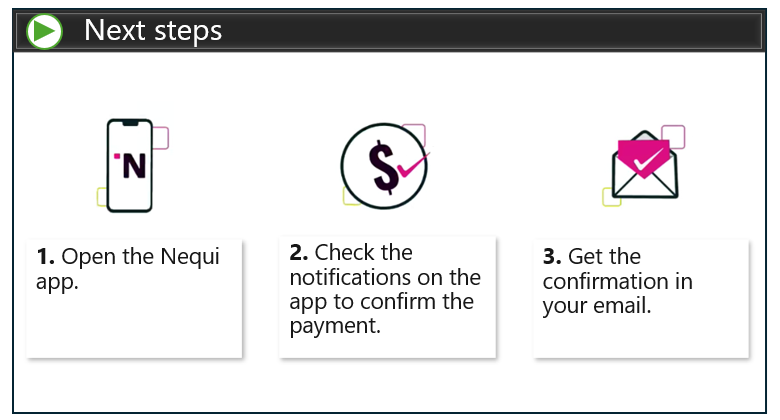

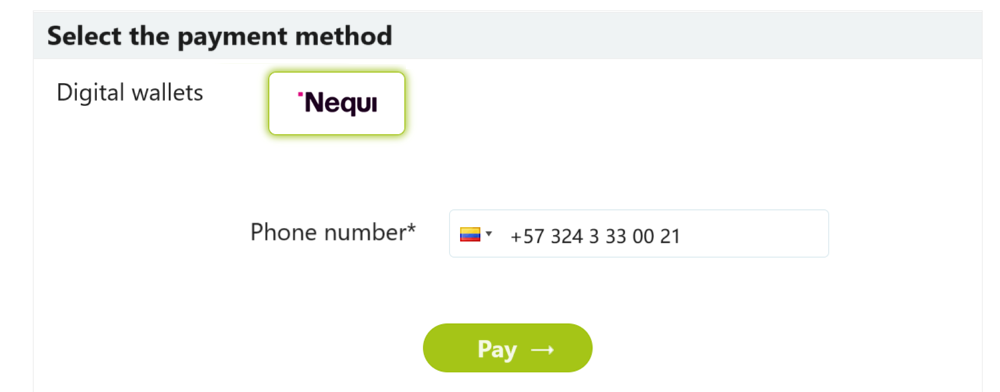

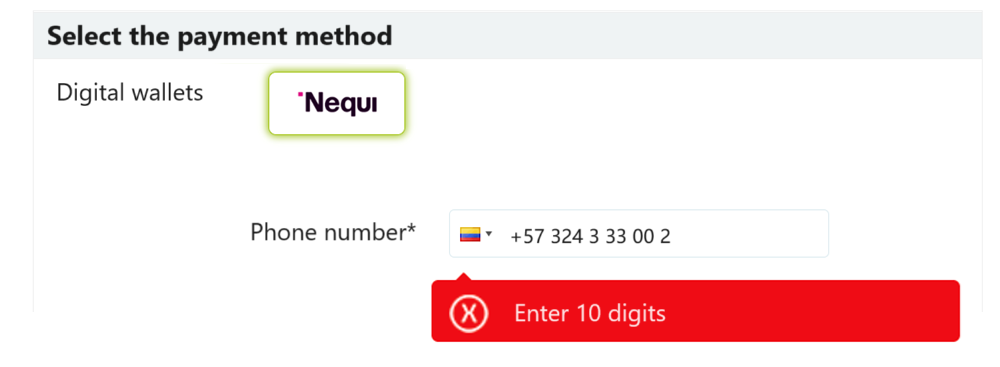

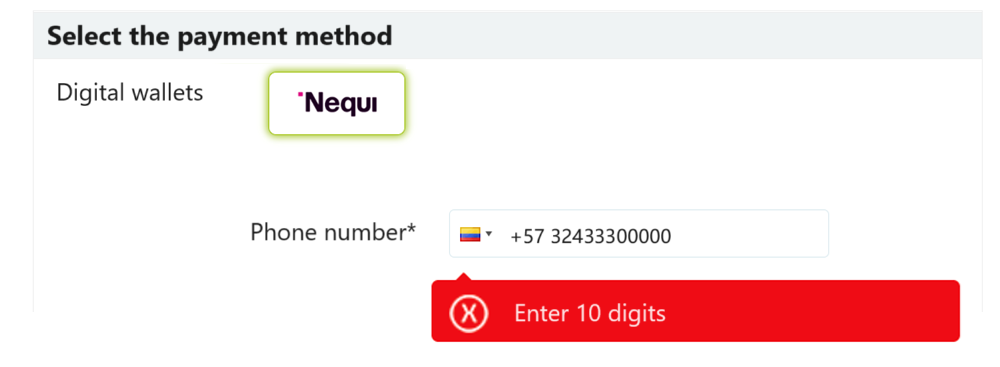

- Submit Transactions Using Nequi

- Submit Transactions Using Bancolombia Button

- Submit Transactions Using Cash or Bank Reference

- Process Payments as an Airline or Travel Agency

- Include Passenger Name Record Information

- Available Payment Methods Query

- Ping

Note

To confirm the status of a transaction, you can use one of the following options:

- Navigate to the the URL set in the

transaction.notifyUrlvariable or the Confirmation URL option located in the Management Panel in Settings > Technical configuration. - Use the Queries API or SDK.

Submit Transactions Using Credit or Debit Cards

This method allows you to process the payments that your customers conduct using credit or debit cards. For Colombia, you can perform one-step flows (Charge). For more information, refer to Payment flows.

Note

Two-step flow is available under request, contact your sales representative.Parameters for Request and Response

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

language |

Alphanumeric | 2 | Language used in the request, this language is used to display the error messages generated. See supported languages. | Yes |

command |

Alphanumeric | Max:32 | Set SUBMIT_TRANSACTION. |

Yes |

test (JSON)isTest (XML) |

Boolean | Set true if the request is in test mode. Otherwise, set false. |

Yes | |

merchant |

Object | This object has the authentication data. | Yes | |

merchant > apiLogin |

Alphanumeric | Min:12 Max:32 | User or login provided by PayU. How do I get my API Login | Yes |

merchant > apiKey |

Alphanumeric | Min:6 Max:32 | Password provided by PayU. How do I get my API Key | Yes |

transaction |

Object | This object has the transaction data. | Yes | |

transaction > order |

Object | This object has the order data. | Yes | |

transaction > order > accountId |

Number | Identifier of your account. | Yes | |

transaction > order > referenceCode |

Alphanumeric | Min:1 Max:255 | Represents the identifier of the order in your system. | Yes |

transaction > order > description |

Alphanumeric | Min:1 Max:255 | Description of the order. | Yes |

transaction > order > language |

Alphanumeric | 2 | Language used in emails sent to the buyer and the seller. | Yes |

transaction > order > notifyUrl |

Alphanumeric | Max:2048 | Confirmation URL of the order. | No |

transaction > order > partnerId |

Alphanumeric | Max:255 | Partner ID in PayU. | No |

transaction > order > signature |

Alphanumeric | Max:255 | The signature associated to the form. For more information refer Authentication signature. | Yes |

transaction > order > shippingAddress |

Object | Shipping address. | No | |

transaction > order > shippingAddress > street1 |

Alphanumeric | Max:100 | Address Line 1. | No |

transaction > order > shippingAddress > street2 |

Alphanumeric | Max:100 | Address Line 2. | No |

transaction > order > shippingAddress > city |

Alphanumeric | Max:50 | Address city. | No |

transaction > order > shippingAddress > state |

Alphanumeric | Max:40 | Address State. | No |

transaction > order > shippingAddress > country |

Alphanumeric | 2 | Address country. | No |

transaction > order > shippingAddress > postalCode |

Alphanumeric | Max:8 | Address Zip code. | No |

transaction > order > shippingAddress > phone |

Alphanumeric | Max:11 | Phone number associated to the address. | No |

transaction > order > buyer |

Object | Buyer information. | Yes | |

transaction > order > buyer > merchantBuyerId |

Alphanumeric | Max:100 | Buyer ID in your system. | No |

transaction > order > buyer > fullName |

Alphanumeric | Max:150 | Full name of the buyer. | Yes |

transaction > order > buyer > emailAddress |

Alphanumeric | Max:255 | E-mail of the buyer. | Yes |

transaction > order > buyer > contactPhone |

Alphanumeric | Max:20 | Phone number of the buyer. | Yes |

transaction > order > buyer > dniNumber |

Alphanumeric | Max:20 | Identification number of the buyer. | Yes |

transaction > order > buyer > shippingAddress |

Alphanumeric | Shipping address of the buyer. | Yes | |

transaction > order > buyer > shippingAddress > street1 |

Alphanumeric | Max:150 | Buyer’s shipping address Line 1. | Yes |

transaction > order > buyer > shippingAddress > city |

Alphanumeric | Max:50 | Buyer’s shipping address city. | Yes |

transaction > order > buyer > shippingAddress > state |

Alphanumeric | Max:40 | Buyer’s shipping address state. | Yes |

transaction > order > buyer > shippingAddress > country |

Alphanumeric | 2 | Buyer’s shipping address country in format ISO 3166 alpha-2. | Yes |

transaction > order > buyer > shippingAddress > postalCode |

Number | Max:20 | Buyer’s shipping address zip code. | Yes |

transaction > order > buyer > shippingAddress > phone |

Number | Max:20 | Buyer’s shipping address phone number. | Yes |

transaction > order > additionalValues |

Object | 64 | Amount of the order and its associated values. | Yes |

transaction > order > additionalValues > TX_VALUE |

Alphanumeric | 64 | Amount of the transaction. | Yes |

transaction > order > additionalValues > TX_VALUE > value |

Number | 12, 2 | Specifies the amount of the transaction. This amount cannot include decimals. | Yes |

transaction > order > additionalValues > TX_VALUE > currency |

Alphanumeric | 3 | ISO code of the currency. See accepted currencies. | No |

transaction > order > additionalValues > TX_TAX |

Alphanumeric | 64 | Amount of the Value Added Tax (IVA - Impuesto al Valor Agregado). | Yes |

transaction > order > additionalValues > TX_TAX > value |

Number | 12, 2 | Specifies the amount of the IVA. If this parameter is not set, PayU applies the current tax value (19%). If the amount does not have IVA, send 0. This value may have two decimal digits. |

No |

transaction > order > additionalValues > TX_TAX > currency |

Alphanumeric | 3 | ISO code of the currency. See accepted currencies. | No |

transaction > order > additionalValues > TX_TAX_RETURN_BASE |

Alphanumeric | 64 | Base value to calculate the IVA. If the amount does not have IVA, send 0. This value may have two decimal digits. |

No |

transaction > order > additionalValues > TX_TAX_RETURN_BASE > value |

Number | 12, 2 | Specifies the base amount of the transaction. | No |

transaction > order > additionalValues > TX_TAX_RETURN_BASE > currency |

Alphanumeric | 3 | ISO code of the currency. See accepted currencies. | No |

transaction > creditCardTokenId |

Alphanumeric | Include this parameter when the transaction is done using a tokenized card; moreover, it is mandatory to also send the parameter transaction.creditCard.expirationDate.For more information, refer to Tokenization API. |

No | |

transaction > creditCard |

Object | Credit card information. This object and its parameters are mandatory when the payment is performed using not tokenized credit card. | No | |

transaction > creditCard |

Object | Credit card information. If you process using debit card, do not send this parameter. This object and its parameters are mandatory when the payment is performed using not tokenized credit card. |

No | |

transaction > creditCard > number |

Alphanumeric | Min:13 Max:20 | Credit card number. | No |

transaction > creditCard > securityCode |

Alphanumeric | Min:1 Max:4 | Credit card security code (CVC2, CVV2, CID). | No |

transaction > creditCard > expirationDate |

Alphanumeric | 7 | Credit card expiration date. Format YYYY/MM. |

No |

transaction > creditCard > name |

Alphanumeric | Min:1 Max:255 | Holder’s name displayed in the credit card. | No |

transaction > creditCard > processWithoutCvv2 |

Boolean | Max:255 | Allows you to process transactions without including the credit card security code. Your commerce requires PayU’s authorization before using this feature. | No |

transaction > debitCard |

Object | Debit card information. This object and its parameters are mandatory when the payment is performed using debit card. | No | |

transaction > debitCard > number |

Alphanumeric | Min:13 Max:20 | Debit card number. | No |

transaction > debitCard > securityCode |

Alphanumeric | Min:1 Max:4 | Debit card security code (CVC2, CVV2, CID). | No |

transaction > debitCard > expirationDate |

Alphanumeric | 7 | Debit card expiration date. Format YYYY/MM. |

No |

transaction > debitCard > name |

Alphanumeric | Min:1 Max:255 | Holder’s name displayed in the debit card. | No |

transaction > payer |

Object | Payer information. | Yes | |

transaction > payer > emailAddress |

Alphanumeric | Max:255 | Payer e-mail address. | Yes |

transaction > payer > merchantPayerId |

Alphanumeric | Max:100 | Identifier of the payer in your system. | No |

transaction > payer > fullName |

Alphanumeric | Max:150 | Name of the payer which must meet the name sent in the parameter transaction.creditCard.name. |

Yes |

transaction > payer > billingAddress |

Object | Billing address. | Yes | |

transaction > payer > billingAddress > street1 |

Alphanumeric | Max:100 | Billing Address Line 1. | Yes |

transaction > payer > billingAddress > street2 |

Alphanumeric | Max:100 | Billing Address Line 2. | No |

transaction > payer > billingAddress > city |

Alphanumeric | Max:50 | Billing address city. | Yes |

transaction > payer > billingAddress > state |

Alphanumeric | Max:40 | Billing address state. | No |

transaction > payer > billingAddress > country |

Alphanumeric | 2 | Billing address country in format ISO 3166 Alpha-2. | Yes |

transaction > payer > billingAddress > postalCode |

Alphanumeric | Max:20 | Billing address zip code. | No |

transaction > payer > billingAddress > phone |

Alphanumeric | Max:20 | Billing address phone number. | No |

transaction > payer > birthdate |

Alphanumeric | Max:10 | Payer’s date of birth. | No |

transaction > payer > contactPhone |

Alphanumeric | Max:20 | Payer’s phone number. | Yes |

transaction > payer > dniNumber |

Alphanumeric | Max:20 | Identification number of the buyer. | Yes |

transaction > payer > dniType |

Alphanumeric | 2 | Identification type of the buyer. See Document types. | No |

transaction > type |

Alphanumeric | 32 | Set this value according to the transaction. For Colombia, set AUTHORIZATION_AND_CAPTURE |

Yes |

transaction > paymentMethod |

Alphanumeric | 32 | Select a valid Credit card Payment Method. See the available Payment Methods for Colombia. | Yes |

transaction > paymentCountry |

Alphanumeric | 2 | Set CO for Colombia. |

Yes |

transaction > deviceSessionId |

Alphanumeric | Max:255 | Session identifier of the device where the customer performs the transaction. For more information, refer to this topic. | Yes |

transaction > ipAddress |

Alphanumeric | Max:39 | IP address of the device where the customer performs the transaction. | Yes |

transaction > cookie |

Alphanumeric | Max:255 | Cookie stored by the device where the customer performs the transaction. | Yes |

transaction > userAgent |

Alphanumeric | Max:1024 | The User agent of the browser where the customer performs the transaction. | Yes |

transaction > extraParameters |

Object | Additional parameters or data associated with the request. The maximum size of each extraParameters name is 64 characters. In JSON, the extraParameters parameter follows this structure: "extraParameters": {"INSTALLMENTS_NUMBER": 1}In XML, the extraParameters parameter follows this structure: <extraParameters><entry><string>INSTALLMENTS_NUMBER</string><string>1</string></entry></extraParameters> |

No | |

transaction > extraParameters > EXTRA1 |

Alphanumeric | Max:512 | Additional field to send extra information about the purchase. | No |

transaction > extraParameters > EXTRA2 |

Alphanumeric | Max:512 | Additional field to send extra information about the purchase. | No |

transaction > extraParameters > EXTRA3 |

Alphanumeric | Max:512 | Additional field to send extra information about the purchase. | No |

transaction > threeDomainSecure |

Object | This object contains the information of 3DS 2.0. | No | |

transaction > threeDomainSecure > embedded |

Boolean | Set true if you want to use and embedded MPI for the Authorization process. By default, this value is set as false. |

No | |

transaction > threeDomainSecure > eci |

Number | Max:2 | Electronic Commerce Indicator. Value returned by the directory servers showing the authentication attempt. This parameter is mandatory when transaction.threeDomainSecure.embedded is false and transaction.threeDomainSecure.xid has been set. |

No |

transaction > threeDomainSecure > cavv |

Alphanumeric | Max:28 | Cardholder Authentication Verification Value. Code of the cryptogram used in the transaction authentication in Base64. Depending on the specific ECI codes established by the process network, this value may be optional. |

No |

transaction > threeDomainSecure > xid |

Alphanumeric | Max:28 | Transaction ID sent by the MPI in Base64. This parameter is mandatory when transaction.threeDomainSecure.embedded is false and transaction.threeDomainSecure.eci has been set. |

No |

transaction > threeDomainSecure > directoryServerTransactionId |

Alphanumeric | Max:36 | Transaction ID generated by the directory server during the authentication. | No |

transaction > digitalWallet |

Object | Include this parameter when the transaction is done using a Digital Wallet. *When sending this object, all its parameters are mandatory. | No | |

transaction > digitalWallet > type |

Alphanumeric | —- | Set this value according to the digital wallet that you are processing: GOOGLE_PAY | Yes* |

transaction > digitalWallet > message |

Alphanumeric | —- | Include the information of the Google Pay Token that Google will return to you for each transaction. For more information consult here. | Yes* |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

code |

Alphanumeric | The response code of the transaction. Possible values are ERROR and SUCCESS. |

|

error |

Alphanumeric | Max:2048 | The error message associated when the response code is ERROR. |

transactionResponse |

Object | The response data. | |

transactionResponse > orderId |

Number | The generated or existing order Id in PayU. | |

transactionResponse > transactionId |

Alphanumeric | 36 | The identifier of the transaction in PayU. |

transactionResponse > state |

Alphanumeric | Max:32 | The status of the transaction. |

transactionResponse > responseCode |

Alphanumeric | Max:64 | The response code associated with the status. |

transactionResponse > paymentNetworkResponseCode |

Alphanumeric | Max:255 | The response code returned by the financial network. |

transactionResponse > paymentNetworkResponseErrorMessage |

Alphanumeric | Max:255 | The error message returned by the financial network. |

transactionResponse > trazabilityCode |

Alphanumeric | Max:32 | The traceability code returned by the financial network. |

transactionResponse > authorizationCode |

Alphanumeric | Max:12 | The authorization code returned by the financial network. |

transactionResponse > responseMessage |

Alphanumeric | Max:2048 | Message associated with the response code. |

transactionResponse > operationDate |

Date | Creation date of the response in the PayU´s system. | |

transactionResponse > extraParameters |

Object | Additional parameters or data associated with the response. In JSON, the extraParameters parameter follows this structure: "extraParameters": {"BANK_REFERENCED_CODE": "CREDIT"}In XML, the extraParameters parameter follows this structure: <extraParameters><entry><string>BANK_REFERENCED_CODE</string><string>CREDIT</string></entry></extraParameters> |

|

transactionResponse > additionalInfo |

Object | Additional information associated with the response. This object follows the same structure than transactionResponse.extraParameters. |

|

transactionResponse > additionalInfo > rejectionType |

Alphanumeric | Max: 4 | Indicates the category of the decline. Possible values: SOFT or HARD. For more information, refer to Considerations. |

Considerations

- Decline Handling (

rejectionType): This feature only applies toAUTHORIZATIONandAUTHORIZATION_AND_CAPTUREtransactions. When a transaction is declined, theadditionalInfo.rejectionTypefield helps determine the retry strategy:- HARD: Indicates a permanent decline. Per network regulations, the merchant should not retry the transaction using the same card data. Frequent retries of “Hard” declines may result in penalties or fines from the financial networks.

- SOFT: Indicates a temporary issue (e.g., insufficient funds). The transaction may be retried at a later time.

- For payments with credit card tokens, include the parameters

transaction.creditCardTokenIdandtransaction.creditCard.securityCode(if you process with security code) replacing the information of the credit card. For more information, refer to Tokenization API. - By default, processing credit cards without security code is not enabled. If you want to enable this feature, contact your Sales representative. After this feature is enabled for you, send in the request the variable

creditCard.processWithoutCvv2as true and remove the variablecreditCard.securityCode. - The variable

transaction.threeDomainSecuredoes not replace the card information nor any of the mandatory fields of the transaction. This object is additional and not mandatory. - The variable

transaction.threeDomainSecurecorresponds to a passthrough scenario where the commerce performs the authentication by their own. - For Crédito Fácil Codensa card, the number of installments supported are 1 to 12, 18, 24, 36 and 48.

- For Crédito Fácil Codensa card, the payer can choose any of the following document types for the variable

transaction.payer.dniType:

| ISO | Description |

|---|---|

CC |

Citizenship card. |

CE |

Foreign citizenship card. |

NIT |

Tax identification number (Companies). |

TI |

Identity Card. |

PP |

Passport. |

IDC |

Customer´s unique identifier, in the case of unique customer / utility consumer ID’s. |

CEL |

When identified by the mobile line. |

RC |

Birth certificate. |

DE |

Foreign identification document. |

API Call

The following are the examples of the request and response of this payment method.

Request Example:

{

"language": "es",

"command": "SUBMIT_TRANSACTION",

"merchant": {

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA",

"apiLogin": "pRRXKOl8ikMmt9u"

},

"transaction": {

"order": {

"accountId": "512321",

"referenceCode": "PRODUCT_TEST_2021-06-23T19:59:43.229Z",

"description": "Payment test description",

"language": "es",

"signature": "1d6c33aed575c4974ad5c0be7c6a1c87",

"notifyUrl": "http://www.payu.com/notify",

"additionalValues": {

"TX_VALUE": {

"value": 65000,

"currency": "COP"

},

"TX_TAX": {

"value": 10378,

"currency": "COP"

},

"TX_TAX_RETURN_BASE": {

"value": 54622,

"currency": "COP"

}

},

"buyer": {

"merchantBuyerId": "1",

"fullName": "First name and second buyer name",

"emailAddress": "buyer_test@test.com",

"contactPhone": "7563126",

"dniNumber": "123456789",

"shippingAddress": {

"street1": "Cr 23 No. 53-50",

"street2": "5555487",

"city": "Bogotá",

"state": "Bogotá D.C.",

"country": "CO",

"postalCode": "000000",

"phone": "7563126"

}

},

"shippingAddress": {

"street1": "Cr 23 No. 53-50",

"street2": "5555487",

"city": "Bogotá",

"state": "Bogotá D.C.",

"country": "CO",

"postalCode": "0000000",

"phone": "7563126"

}

},

"payer": {

"merchantPayerId": "1",

"fullName": "First name and second payer name",

"emailAddress": "payer_test@test.com",

"contactPhone": "7563126",

"dniNumber": "5415668464654",

"billingAddress": {

"street1": "Cr 23 No. 53-50",

"street2": "125544",

"city": "Bogotá",

"state": "Bogotá D.C.",

"country": "CO",

"postalCode": "000000",

"phone": "7563126"

}

},

"creditCard": {

"number": "4037997623271984",

"securityCode": "321",

"expirationDate": "2030/12",

"name": "APPROVED"

},

"extraParameters": {

"INSTALLMENTS_NUMBER": 1

},

"type": "AUTHORIZATION_AND_CAPTURE",

"paymentMethod": "VISA",

"paymentCountry": "CO",

"deviceSessionId": "vghs6tvkcle931686k1900o6e1",

"ipAddress": "127.0.0.1",

"cookie": "pt1t38347bs6jc9ruv2ecpv7o2",

"userAgent": "Mozilla/5.0 (Windows NT 5.1; rv:18.0) Gecko/20100101 Firefox/18.0",

"threeDomainSecure": {

"embedded": false,

"eci": "01",

"cavv": "AOvG5rV058/iAAWhssPUAAADFA==",

"xid": "Nmp3VFdWMlEwZ05pWGN3SGo4TDA=",

"directoryServerTransactionId": "00000-70000b-5cc9-0000-000000000cb"

}

},

"test": true

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"transactionResponse": {

"orderId": 1400449660,

"transactionId": "aa2f50b2-62a8-42de-b3be-c6fe08ec712f",

"state": "APPROVED",

"paymentNetworkResponseCode": "81",

"paymentNetworkResponseErrorMessage": null,

"trazabilityCode": "CRED - 666039677",

"authorizationCode": "123238",

"pendingReason": null,

"responseCode": "APPROVED",

"errorCode": null,

"responseMessage": "Approved by the merchant",

"transactionDate": null,

"transactionTime": null,

"operationDate": 1624461913704,

"referenceQuestionnaire": null,

"extraParameters": {

"BANK_REFERENCED_CODE": "CREDIT"

},

"additionalInfo": {

"paymentNetwork": "CREDIBANCO",

"rejectionType": "NONE",

"responseNetworkMessage": null,

"travelAgencyAuthorizationCode": null,

"cardType": "CREDIT",

"transactionType": "AUTHORIZATION_AND_CAPTURE"

}

}

}

Request Example:

<request>

<language>es</language>

<command>SUBMIT_TRANSACTION</command>

<merchant>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

</merchant>

<transaction>

<order>

<accountId>512321</accountId>

<referenceCode>PRODUCT_TEST_2021-06-23T19:59:43.229Z</referenceCode>

<description>Payment test description</description>

<language>es</language>

<signature>1d6c33aed575c4974ad5c0be7c6a1c87</signature>

<notifyUrl>http://www.payu.com/notify</notifyUrl>

<additionalValues>

<entry>

<string>TX_VALUE</string>

<additionalValue>

<value>65000</value>

<currency>COP</currency>

</additionalValue>

<string>TX_TAX</string>

<additionalValue>

<value>10378</value>

<currency>COP</currency>

</additionalValue>

<string>TX_TAX_RETURN_BASE</string>

<additionalValue>

<value>54622</value>

<currency>COP</currency>

</additionalValue>

</entry>

</additionalValues>

<buyer>

<merchantBuyerId>1</merchantBuyerId>

<fullName>First name and second buyer name</fullName>

<emailAddress>buyer_test@test.com</emailAddress>

<contactPhone>7563126</contactPhone>

<dniNumber>123456789</dniNumber>

<shippingAddress>

<street1>Cr 23 No. 53-50</street1>

<street2>5555487</street2>

<city>Bogotá</city>

<state>Bogotá D.C.</state>

<country>CO</country>

<postalCode>000000</postalCode>

<phone>7563126</phone>

</shippingAddress>

</buyer>

<shippingAddress>

<street1>Cr 23 No. 53-50</street1>

<street2>5555487</street2>

<city>Bogotá</city>

<state>Bogotá D.C.</state>

<country>CO</country>

<postalCode>0000000</postalCode>

<phone>7563126</phone>

</shippingAddress>

</order>

<payer>

<merchantPayerId>1</merchantPayerId>

<fullName>First name and second payer name</fullName>

<emailAddress>payer_test@test.com</emailAddress>

<contactPhone>7563126</contactPhone>

<dniNumber>5415668464654</dniNumber>

<billingAddress>

<street1>Cr 23 No. 53-50</street1>

<street2>5555487</street2>

<city>Bogotá</city>

<state>Bogotá D.C.</state>

<country>CO</country>

<postalCode>000000</postalCode>

<phone>7563126</phone>

</billingAddress>

</payer>

<creditCard>

<number>4037997623271984</number>

<securityCode>321</securityCode>

<expirationDate>2030/12</expirationDate>

<name>APPROVED</name>

</creditCard>

<extraParameters>

<entry>

<string>INSTALLMENTS_NUMBER</string>

<string>1</string>

</entry>

</extraParameters>

<type>AUTHORIZATION_AND_CAPTURE</type>

<paymentMethod>VISA</paymentMethod>

<paymentCountry>CO</paymentCountry>

<deviceSessionId>vghs6tvkcle931686k1900o6e1</deviceSessionId>

<ipAddress>127.0.0.1</ipAddress>

<cookie>pt1t38347bs6jc9ruv2ecpv7o2</cookie>

<userAgent>Mozilla/5.0 (Windows NT 5.1; rv:18.0) Gecko/20100101 Firefox/18.0</userAgent>

<threeDomainSecure>

<embedded>false</embedded>

<eci>01</eci>

<cavv>AOvG5rV058/iAAWhssPUAAADFA==</cavv>

<xid>Nmp3VFdWMlEwZ05pWGN3SGo4TDA=</xid>

<directoryServerTransactionId>00000-70000b-5cc9-0000-000000000cb</directoryServerTransactionId>

</threeDomainSecure>

</transaction>

<isTest>false</isTest>

</request>

Response Example:

<paymentResponse>

<code>SUCCESS</code>

<transactionResponse>

<orderId>1400449666</orderId>

<transactionId>c29d0543-810d-48c4-bd3e-163e935c2173</transactionId>

<state>APPROVED</state>

<paymentNetworkResponseCode>79</paymentNetworkResponseCode>

<trazabilityCode>CRED - 666116683</trazabilityCode>

<authorizationCode>787517</authorizationCode>

<responseCode>APPROVED</responseCode>

<responseMessage>Approved administrative transaction</responseMessage>

<operationDate>2021-06-23T10:26:28</operationDate>

<extraParameters>

<entry>

<string>BANK_REFERENCED_CODE</string>

<string>CREDIT</string>

</entry>

</extraParameters>

<additionalInfo>

<paymentNetwork>CREDIBANCO</paymentNetwork>

<rejectionType>NONE</rejectionType>

<cardType>CREDIT</cardType>

<transactionType>AUTHORIZATION_AND_CAPTURE</transactionType>

</additionalInfo>

</transactionResponse>

</paymentResponse>

Submit Transactions Using Bre-B QR

This method allows you to process payments made by your customers through Bre-B QR code. To integrate with this payment method, you must display a QR code on your checkout page so that the customer can scan it using their banking app or digital wallet to complete the payment.

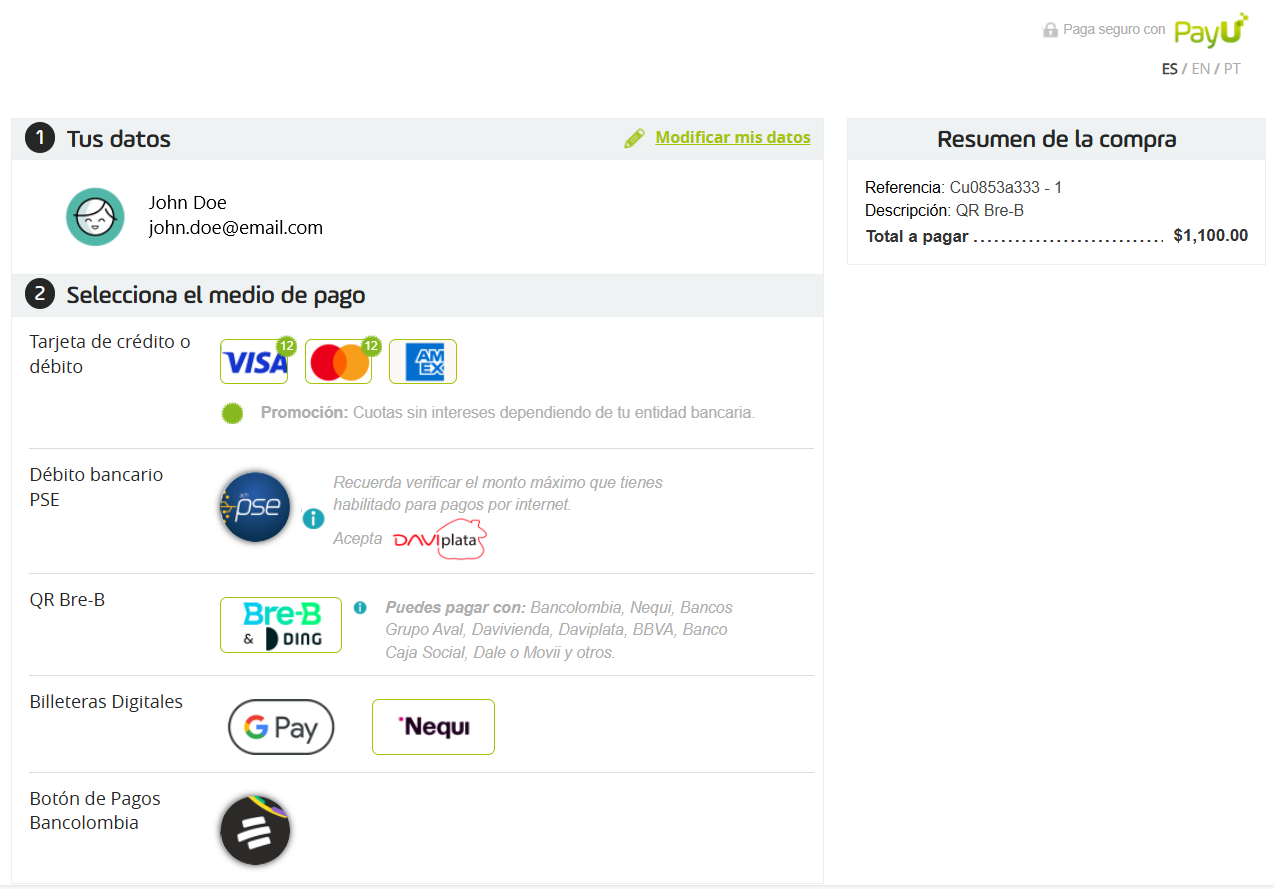

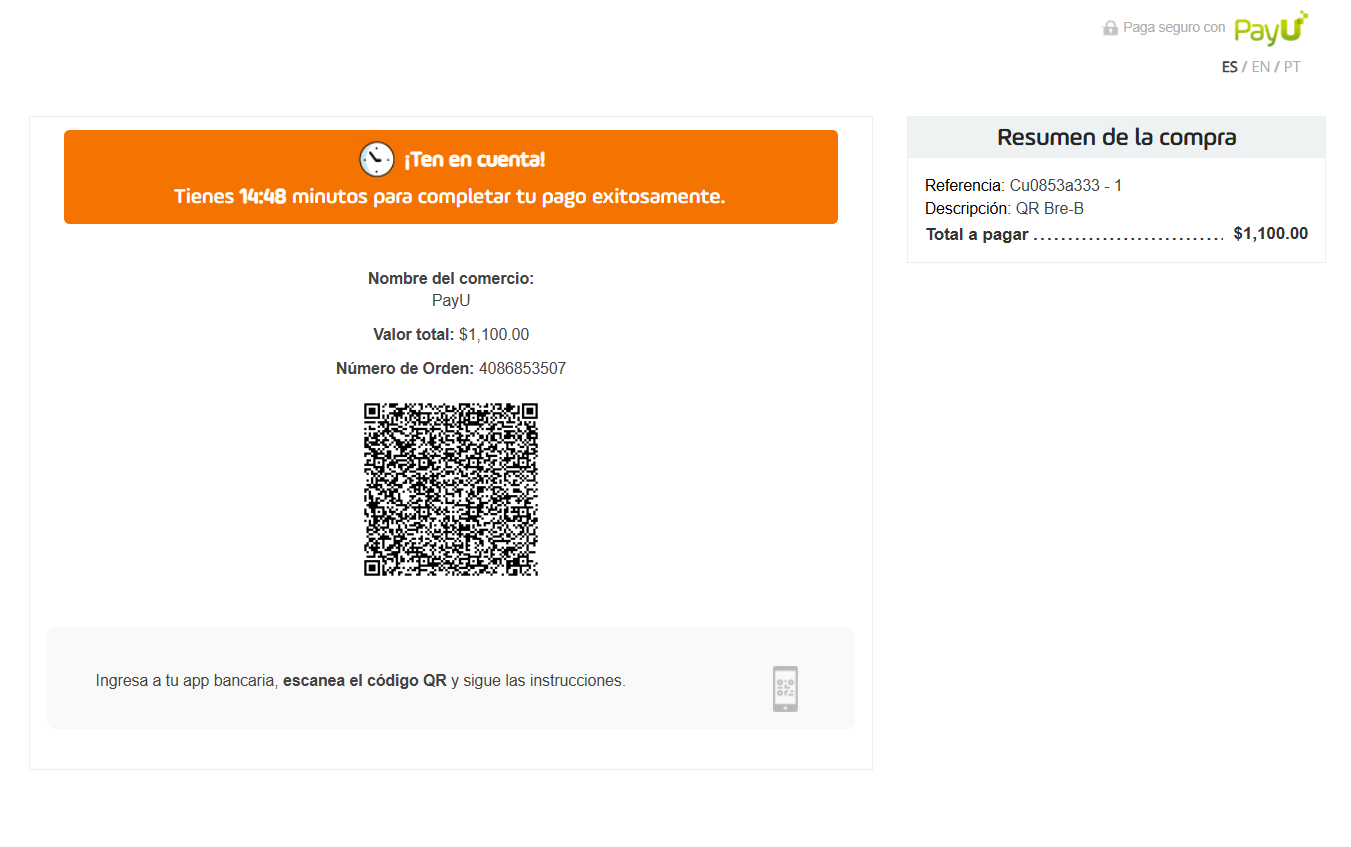

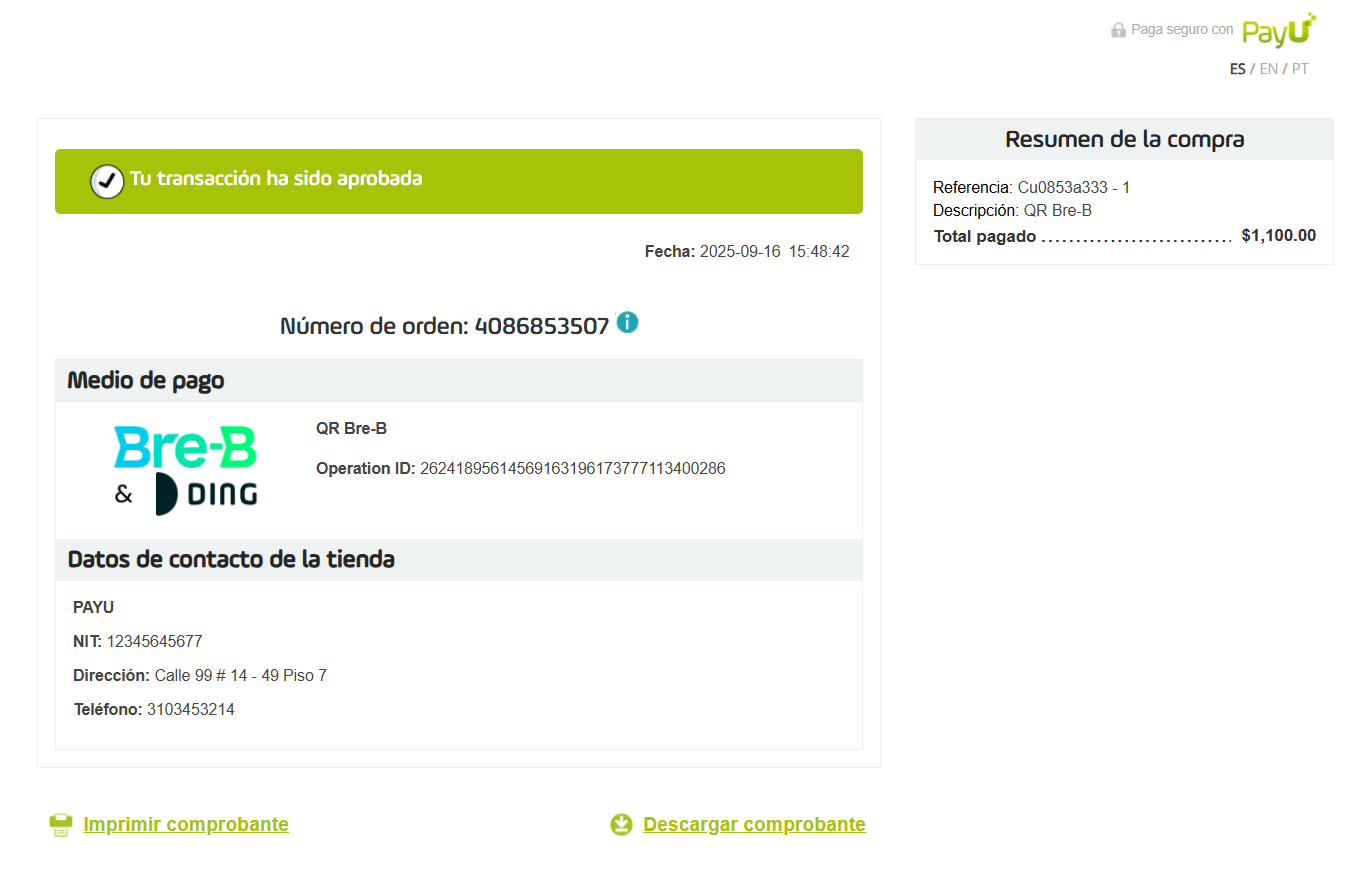

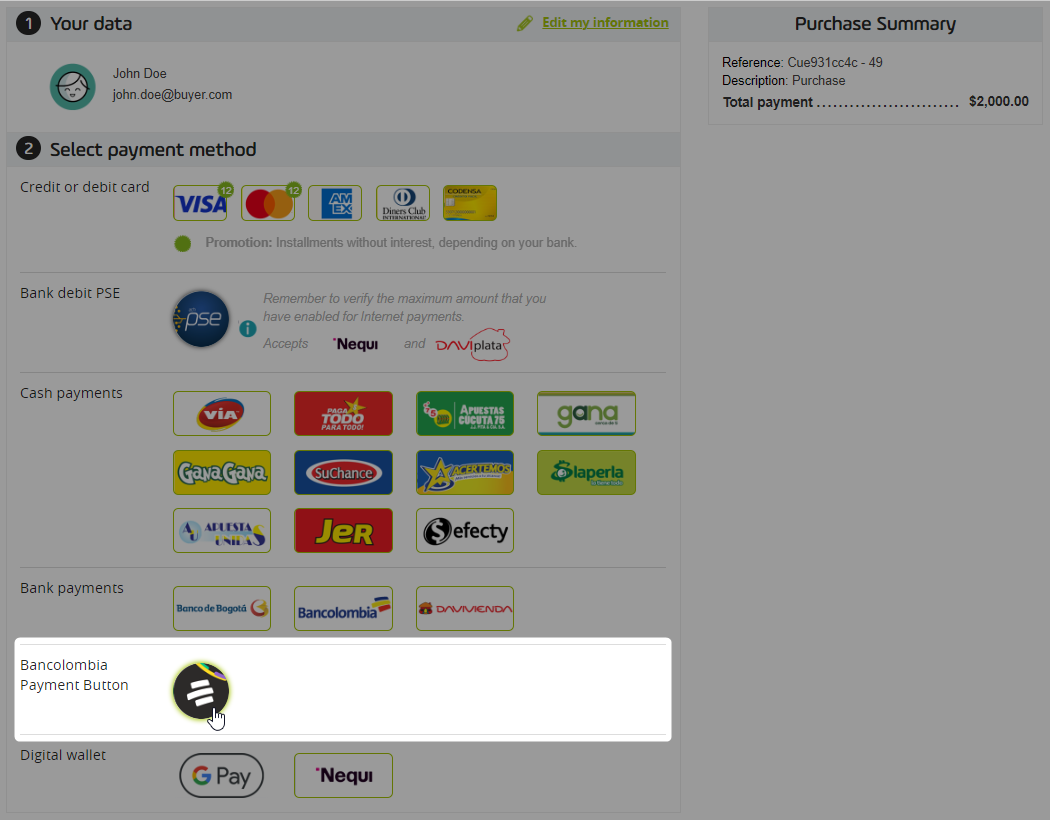

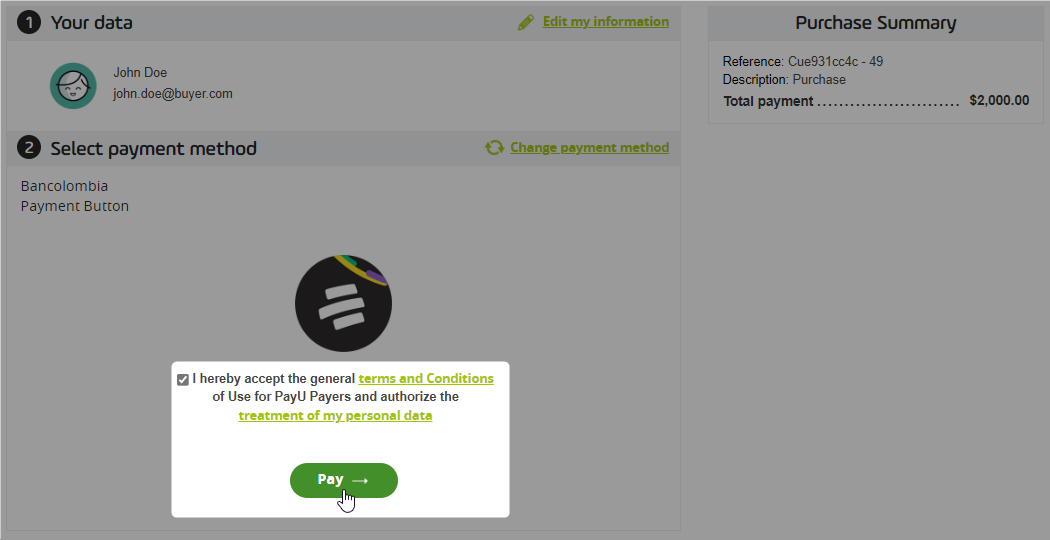

At the end of the process, the customer will see a payment page like the one below:

How Does Bre-B QR Work?

Bre-B QR enables fast and secure payments. It is an online payment method where the payer scans a dynamic QR code with a fixed amount using any compatible banking app or digital wallet and follows the steps indicated by their financial institution.

As an interoperable system, payers can scan the QR code using the main financial institutions in the country, among others. Once the payment is completed, you will receive the funds immediately in your PayU virtual account.

Availability

Bre-B QR is available in different integration models, allowing you to easily implement it according to your payment channel or flow.

You can enable it in any of the following options:

- Aggregator Model (PSP)

- Web Checkout Integration

- API Integration

- Payment Link (available from the Merchant Panel and the PayU App)

User Experience

Bre-B QR offers two types of user experiences:

- PC Experience: The QR code is generated on a computer. The payer scans it with their smartphone using a banking app or digital wallet to complete the payment.

- Mobile Experience: The QR code is generated directly on the smartphone. The payer saves the QR image in their gallery and uploads it in their banking app or digital wallet to complete the payment.

Considerations

Before implementing Bre-B QR, consider the following technical and user experience aspects. These recommendations will help you ensure a proper integration process and a smooth payment experience for your customers.

- Make sure this payment method is enabled in your PayU account. If it is not yet active, request it by writing to comercios.co@payu.com.

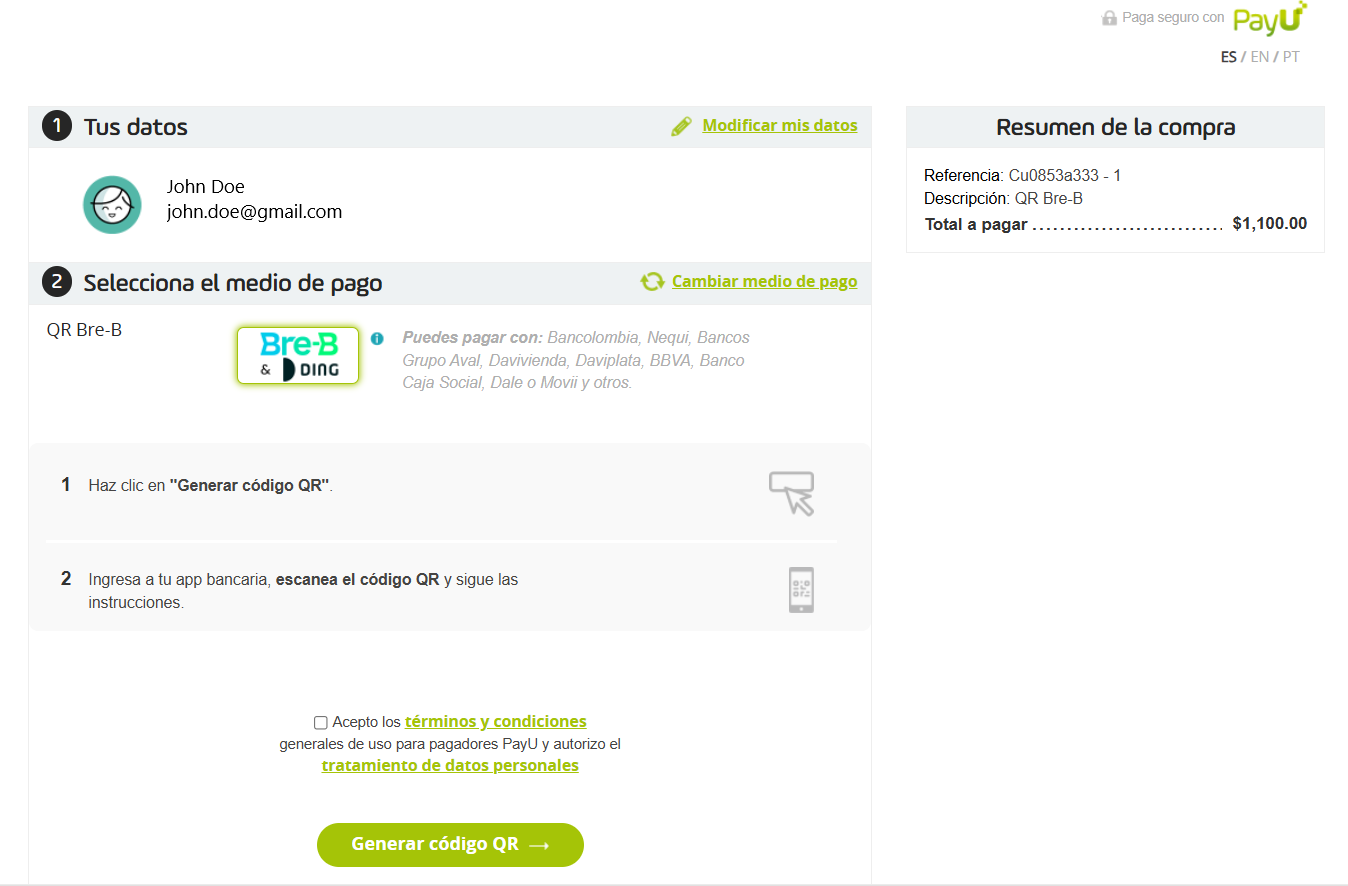

- The QR code is generated as a base64 image, with dimensions of 158x158 px and PNG format.

- The QR code expires 15 minutes after it is generated. Include a visible timer to indicate the remaining time before expiration.

- In the user experience, include the Bre-B & DING logo and the payment method name “Bre-B QR”.

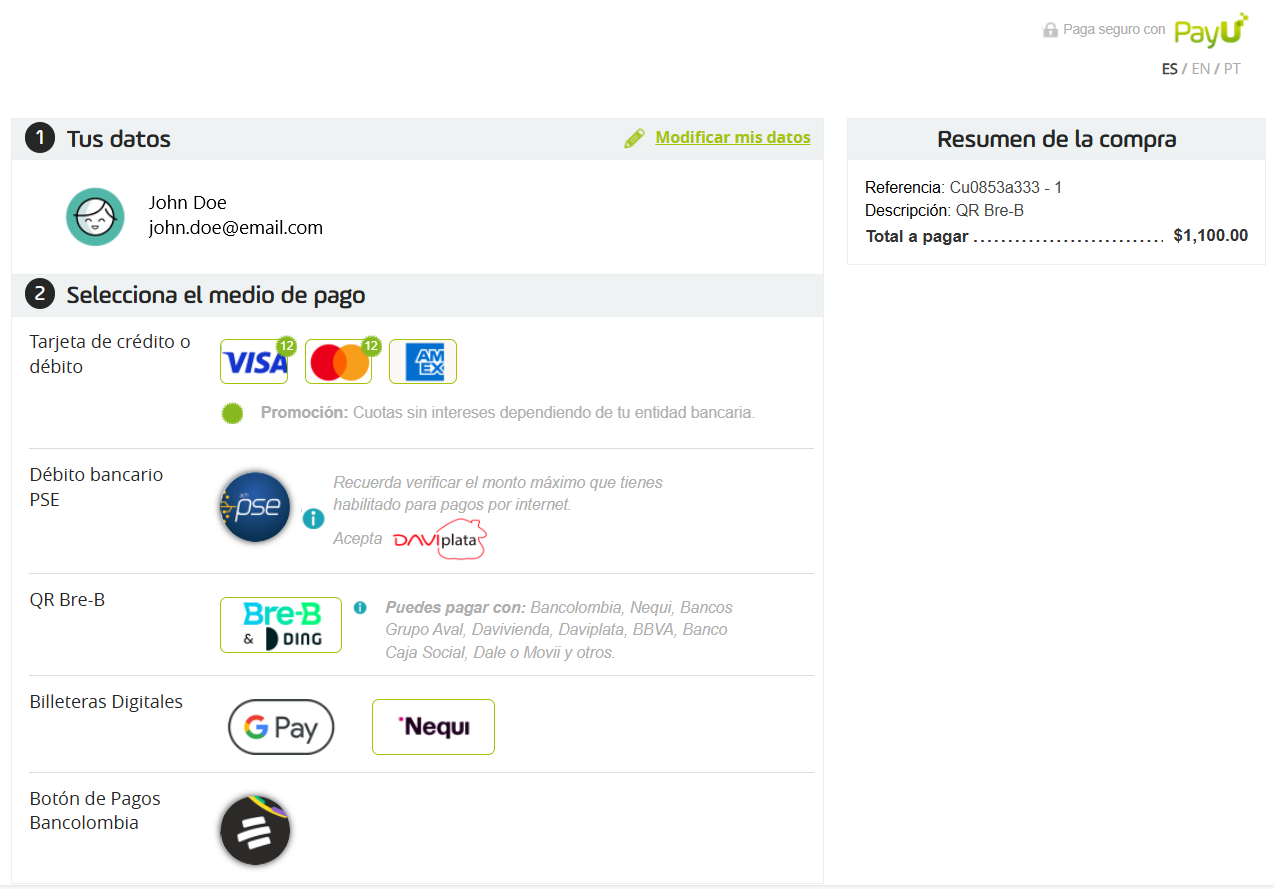

- Make sure to display the payer instructions and form fields as shown in the following images.

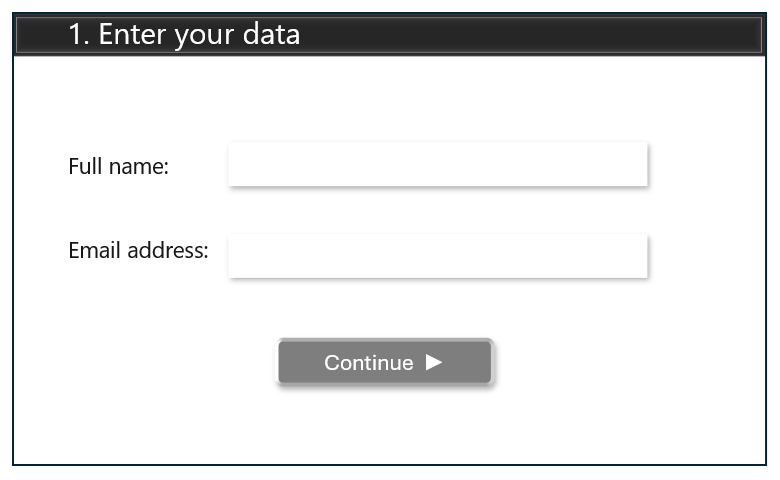

- Request the payer’s details.

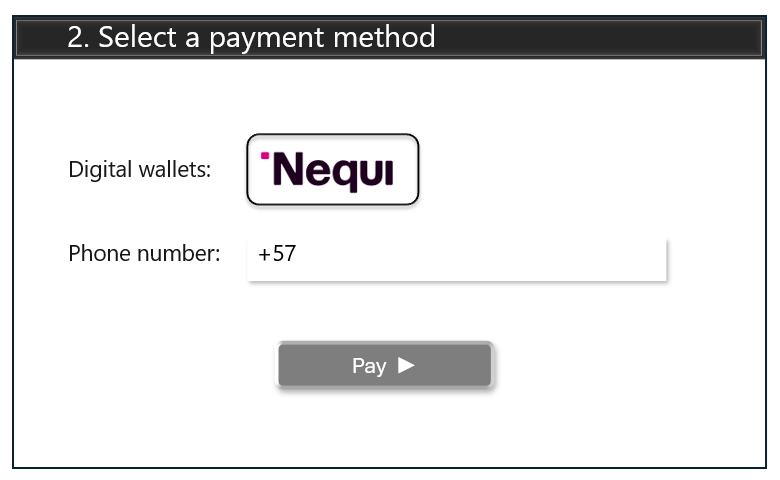

- Display the available payment methods.

- When the user selects Bre-B QR, display the instructions they must follow to complete the payment.

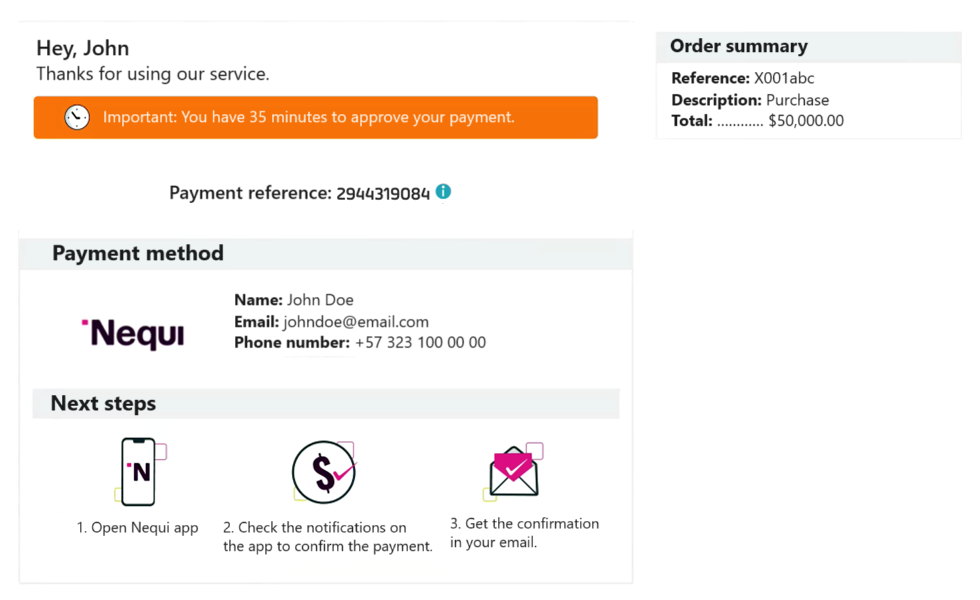

- Generate and display the QR code that the payer must scan, along with a timer indicating the remaining time before the code expires.

- Once the payment is completed, display the summary of the successful transaction, including billing details or any other relevant information for the payer, as applicable.

Request and Response Parameters

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

language |

Alphanumeric | 2 | Language used in the request. This language determines the error messages displayed. See supported languages. | Yes |

command |

Alphanumeric | Max:32 | Assign SUBMIT_TRANSACTION. |

Yes |

test (JSON)isTest (XML) |

Boolean | Assign true if the request is in test mode. Otherwise, assign false. |

Yes | |

merchant |

Object | This object contains the authentication data. | Yes | |

merchant > apiLogin |

Alphanumeric | Min:12 Max:32 | User or login provided by PayU. How to obtain my API Login. | Yes |

merchant > apiKey |

Alphanumeric | Min:6 Max:32 | Password provided by PayU. How to obtain my API Key. | Yes |

transaction |

Object | This object contains the transaction data. | Yes | |

transaction > order |

Object | This object contains the order data. | Yes | |

transaction > order > accountId |

Numeric | Identifier of your account. | Yes | |

transaction > order > referenceCode |

Alphanumeric | Min:1 Max:255 | Represents the order identifier in your system. | Yes |

transaction > order > description |

Alphanumeric | Min:1 Max:255 | Description of the order. | Yes |

transaction > order > language |

Alphanumeric | 2 | Language used in the emails sent to the buyer and the seller. | Yes |

transaction > order > notifyUrl |

Alphanumeric | Max:2048 | Order confirmation URL. | No |

transaction > order > partnerId |

Alphanumeric | Max:255 | Partner ID within PayU. | No |

transaction > order > signature |

Alphanumeric | Max:255 | Signature associated with the form. For more information, see Authentication Signature. | Yes |

transaction > order > shippingAddress |

Object | Shipping address. | No | |

transaction > order > shippingAddress > street1 |

Alphanumeric | Max:100 | Address line 1. | No |

transaction > order > shippingAddress > street2 |

Alphanumeric | Max:100 | Address line 2. | No |

transaction > order > shippingAddress > city |

Alphanumeric | Max:50 | City of the address. | No |

transaction > order > shippingAddress > state |

Alphanumeric | Max:40 | State or department of the address. | No |

transaction > order > shippingAddress > country |

Alphanumeric | 2 | Country of the address. | No |

transaction > order > shippingAddress > postalCode |

Alphanumeric | Max:8 | Postal code of the address. | No |

transaction > order > shippingAddress > phone |

Alphanumeric | Max:11 | Phone number associated with the address. | No |

transaction > order > buyer |

Object | Buyer information. | Yes | |

transaction > order > buyer > merchantBuyerId |

Alphanumeric | Max:100 | Identifier of the buyer in your system. | No |

transaction > order > buyer > fullName |

Alphanumeric | Max:150 | Buyer’s full name. | Yes |

transaction > order > buyer > emailAddress |

Alphanumeric | Max:255 | Buyer’s email address. | No |

transaction > order > buyer > contactPhone |

Alphanumeric | Max:20 | Buyer’s phone number. | No |

transaction > order > buyer > dniNumber |

Alphanumeric | Max:20 | Buyer’s identification number. | No |

transaction > order > buyer > shippingAddress |

Object | Buyer’s shipping address. | No | |

transaction > order > buyer > shippingAddress > street1 |

Alphanumeric | Max:150 | Buyer’s address line 1. | No |

transaction > order > buyer > shippingAddress > city |

Alphanumeric | Max:50 | Buyer’s city. | No |

transaction > order > buyer > shippingAddress > state |

Alphanumeric | Max:40 | Buyer’s state or department. | No |

transaction > order > buyer > shippingAddress > country |

Alphanumeric | 2 | Buyer’s country in ISO 3166 alpha-2 format. | No |

transaction > order > buyer > shippingAddress > postalCode |

Numeric | Max:20 | Buyer’s postal code. | No |

transaction > order > buyer > shippingAddress > phone |

Numeric | Max:20 | Buyer’s address phone number. | No |

transaction > order > additionalValues |

Object | 64 | Order amount and associated values. | Yes |

transaction > order > additionalValues > TX_VALUE |

Alphanumeric | 64 | Transaction amount. | Yes |

transaction > order > additionalValues > TX_VALUE > value |

Numeric | 12, 2 | Specifies the transaction amount. This value cannot include decimals. | Yes |

transaction > order > additionalValues > TX_VALUE > currency |

Alphanumeric | 3 | ISO currency code. See accepted currencies. | Yes |

transaction > payer |

Object | Payer information. | Yes | |

transaction > payer > emailAddress |

Alphanumeric | Max:255 | Payer’s email address. | No |

transaction > payer > merchantPayerId |

Alphanumeric | Max:100 | Identifier of the payer in your system. | No |

transaction > payer > fullName |

Alphanumeric | Max:150 | Payer’s full name. | Yes |

transaction > payer > billingAddress |

Object | Billing address. | No | |

transaction > payer > billingAddress > street1 |

Alphanumeric | Max:100 | Billing address line 1. | No |

transaction > payer > billingAddress > street2 |

Alphanumeric | Max:100 | Billing address line 2. | No |

transaction > payer > billingAddress > city |

Alphanumeric | Max:50 | Billing address city. | No |

transaction > payer > billingAddress > state |

Alphanumeric | Max:40 | Billing address state or department. | No |

transaction > payer > billingAddress > country |

Alphanumeric | 2 | Billing address country in ISO 3166 Alpha-2 format. | No |

transaction > payer > billingAddress > postalCode |

Alphanumeric | Max:20 | Billing address postal code. | No |

transaction > payer > billingAddress > phone |

Alphanumeric | Max:20 | Billing address phone number. | No |

transaction > payer > birthdate |

Alphanumeric | Max:10 | Payer’s date of birth. | No |

transaction > payer > contactPhone |

Alphanumeric | Max:20 | Payer’s phone number. | No |

transaction > payer > dniNumber |

Alphanumeric | Max:20 | Payer’s identification number. | No |

transaction > payer > dniType |

Alphanumeric | 2 | Payer’s identification type. See document types. | Yes |

transaction > type |

Alphanumeric | 32 | The available transaction type is AUTHORIZATION_AND_CAPTURE. |

Yes |

transaction > paymentMethod |

Alphanumeric | 32 | Select a valid bank transfer payment method. See available payment methods for Colombia. | Yes |

transaction > paymentCountry |

Alphanumeric | 2 | Assign CO for Colombia. |

Yes |

transaction > deviceSessionId |

Alphanumeric | Max:255 | Device session identifier where the customer performs the transaction. For more information, see this article. | Yes |

transaction > ipAddress |

Alphanumeric | Max:39 | IP address of the device where the customer performs the transaction. | Yes |

transaction > cookie |

Alphanumeric | Max:255 | Cookie stored by the device where the customer performs the transaction. | Yes |

transaction > userAgent |

Alphanumeric | Max:1024 | Browser user agent where the customer performs the transaction. | Yes |

transaction > extraParameters |

Object | Additional parameters or data associated with the request. | Yes |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

code |

Alphanumeric | Transaction response code. Possible values are ERROR and SUCCESS. |

|

error |

Alphanumeric | Max:2048 | Error message associated when the response code is ERROR. |

transactionResponse |

Object | Response data. | |

transactionResponse > orderId |

Numeric | Generated or existing order identifier in PayU. | |

transactionResponse > transactionId |

Alphanumeric | 36 | Transaction identifier in PayU. |

transactionResponse > state |

Alphanumeric | Max:32 | Transaction status. Since the payment is processed externally, the status of a successful transaction is PENDING. |

transactionResponse > paymentNetworkResponseCode |

Alphanumeric | Max:255 | Response code returned by the banking network. |

transactionResponse > paymentNetworkResponseErrorMessage |

Alphanumeric | Max:255 | Error message returned by the banking network. |

transactionResponse > trazabilityCode |

Alphanumeric | Max:32 | Traceability code returned by the banking network. |

transactionResponse > authorizationCode |

Alphanumeric | Max:12 | Authorization code returned by the banking network. |

transactionResponse > pendingReason |

Alphanumeric | Max:21 | Reason code associated with the transaction status. As mentioned in transactionResponse > state, the transaction is pending payment. |

transactionResponse > responseCode |

Alphanumeric | Max:64 | Response code associated with the transaction status. In this case, for a successful transaction it is PENDING_TRANSACTION_CONFIRMATION. |

transactionResponse > responseMessage |

Alphanumeric | Max:2048 | Message associated with the response code. |

transactionResponse > operationDate |

Date | Date when the response was created in the PayU system. | |

transactionResponse > extraParameters |

Object | Additional parameters or data associated with the response. |

API Call

The following are the request and response bodies for this payment method.

Request Example:

{

"language": "es",

"command": "SUBMIT_TRANSACTION",

"merchant": {

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA",

"apiLogin": "pRRXKOl8ikMmt9u"

},

"transaction": {

"order": {

"accountId": "521245",

"referenceCode": "Houston 123456789918",

"description": "Houston",

"language": "en",

"notifyUrl": "http://www.test.com/confirmation",

"additionalValues": {

"TX_VALUE": {

"value": 1000,

"currency": "COP"

}

},

"buyer": {

"merchantBuyerId": "1",

"fullName": "APPROVED",

"emailAddress": "john.doe@email.com",

"contactPhone": "7563126",

"dniNumber": "5415668464654",

"shippingAddress": {

"street1": "calle 99",

"street2": "123",

"city": "Medellin",

"state": "Antioquia",

"country": "CO",

"postalCode": "0000000",

"phone": "7563126"

}

},

"shippingAddress": {

"street1": "calle 99",

"street2": "123",

"city": "Medellin",

"state": "Antioquia",

"country": "CO",

"postalCode": "0000000",

"phone": "7563126"

}

},

"payer": {

"merchantPayerId": "1",

"fullName": "APPROVED",

"emailAddress": "john.doe@payu.com",

"contactPhone": "7563126",

"dniNumber": "5415668464654",

"billingAddress": {

"street1": "calle 99",

"street2": "123",

"city": "Bogota",

"state": "Bogota",

"country": "CO",

"postalCode": "0000000",

"phone": "7563126"

}

},

"type": "AUTHORIZATION_AND_CAPTURE",

"paymentMethod": "INTEROPERABLE_QR",

"paymentCountry": "CO"

},

"test": false

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"transactionResponse": {

"orderId": 1438936173,

"transactionId": "bccc494c-97bf-4b7b-84ec-a7e9dac15449",

"state": "PENDING",

"paymentNetworkResponseCode": null,

"paymentNetworkResponseErrorMessage": null,

"trazabilityCode": "a7463eca-3197-4a7f-8928-fbc7ca6017ea",

"authorizationCode": null,

"pendingReason": "AWAITING_NOTIFICATION",

"responseCode": "PENDING_TRANSACTION_CONFIRMATION",

"errorCode": null,

"responseMessage": null,

"transactionDate": null,

"transactionTime": null,

"operationDate": 1741780199019,

"referenceQuestionnaire": null,

"extraParameters": {

"EXPIRATION_DATE": 1742490236444,

"URL_PAYMENT_RECEIPT_PDF": "http://ppp-web-gateway-payu.transactional.payu.preprod/ppp-web-gateway-payu/receipt?vid=1438936173Ybccc494c97bf4b7Y5f4bcef70c4d7b6",

"QRCODE_IMAGE_BASE64": "iVBORw0KGgoAAAANSUhEUgAAAJ4AAACeAQAAAADr/o7WAAAEG0lEQVR4Xn2XQYqjOwyEDd4KdBWDtwZfXaCtQFcxaCvQlPN2M/5faJLuD5K2paqS0urfR7a/SV0oLY96rhjU19nF2egNPb3x6LHdTsywYWVvaFQ1/JzJyZSHwuQT4gNGrDMikj34f2BsCunhkq0NSvqCntqnuk5eI2fFyN85H1Ca/fX43f0Bq06P4xa6WlaU/1fPBxTiIbO1tYPa9mwx1xtqHedR1ktOtVFl/gWT8Owtxt7cVWnKB7Teh5xjnc/IDGdxe0NfGw1xJllyNseZa71hTvyJS8bWUBqdU+gNqznXVp62Bxp3htL6gKH7GI/w1shPpfoHjDaXoNAsVglFtH7L94JV5CqxdPcTrtQW38a94Nni0Qf7WIfkTG3rA3aRLZEoXSTku+Ke8wUdqm6zZspV1gmOmW8IPy0V2/AMT1Y6Bv08oeY6Nd2moW8Dr9vpDYNnP1C1MhrDzUoh2yesRmvjiWIeOBfa5NujF3Q96a6+kzIVvdN8QydtcD6UsNLG0XVF+4TBEqPYqpakT2OWD+jCzK3xlN7a8Witf8BgNGOWoiYOMVDF/oBqshAsNfoqfIZDtPmGsttahbN36oqwQlTaG1ZjhBWc7yuLEZR8FfKCoSVm3jsjKgnZ9jvnC6Yd/B9Cw9bMrrZSPqD5gaA69I9A48A10eInrBOQt993zWLP0fVq/gF1qt2DByoYKB3cS2+IfsH7MadOZBAarTjSE4rXhrbPcrjm3oJvVD7h6ilw38HBahykqn9AWN944u0bHJbB2egNT1vJrQTF3koIP0KLn9A2xL2vo2++QuWR9oZHRrakWDLQN5lcPd/Qe66tQn0LKW868wuqMNUQDtk4nflunT6gSx+JJ1kr1+DtuMATJgbYPmS09PwKTD8tPSBcrQMjsoQwnw16uC5+wcBEhFXaYDmt3/Sjm8kPiAOd5ja41u4chnFCb2hDjBtCVW5o+ZSwLxiLcLvMmxg07sD6gIrJgD1GF4Y+ftcGQ3xAbAZatqbi4dPXtFvPBxRL3GBIbkwURJDfIfWESIcDnS4==",

"URL_PAYMENT_RECEIPT_HTML": "http://ppp-web-gateway-payu.transactional.payu.preprod/ppp-web-gateway-payu/app/v2?vid=1438936173Ybccc494c97bf4b7Y5f4bcef70c4d7b6"

},

"additionalInfo": null

}

}

Request Example:

<request>

<language>es</language>

<command>SUBMIT_TRANSACTION</command>

<merchant>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

</merchant>

<transaction>

<order>

<accountId>521245</accountId>

<referenceCode>Houston 123456789918</referenceCode>

<description>Houston</description>

<language>en</language>

<notifyUrl>http://www.test.com/confirmation</notifyUrl>

<additionalValues>

<TX_VALUE>

<value>1000</value>

<currency>COP</currency>

</TX_VALUE>

</additionalValues>

<buyer>

<merchantBuyerId>1</merchantBuyerId>

<fullName>APPROVED</fullName>

<emailAddress>john.doe@payu.com</emailAddress>

<contactPhone>7563126</contactPhone>

<dniNumber>5415668464654</dniNumber>

<shippingAddress>

<street1>calle 99</street1>

<street2>123</street2>

<city>Medellin</city>

<state>Antioquia</state>

<country>CO</country>

<postalCode>0000000</postalCode>

<phone>7563126</phone>

</shippingAddress>

</buyer>

<shippingAddress>

<street1>calle 99</street1>

<street2>123</street2>

<city>Medellin</city>

<state>Antioquia</state>

<country>CO</country>

<postalCode>0000000</postalCode>

<phone>7563126</phone>

</shippingAddress>

</order>

<payer>

<merchantPayerId>1</merchantPayerId>

<fullName>APPROVED</fullName>

<emailAddress>john.doe@payu.com</emailAddress>

<contactPhone>7563126</contactPhone>

<dniNumber>5415668464654</dniNumber>

<billingAddress>

<street1>calle 99</street1>

<street2>123</street2>

<city>Bogota</city>

<state>Bogota</state>

<country>CO</country>

<postalCode>0000000</postalCode>

<phone>7563126</phone>

</billingAddress>

</payer>

<type>AUTHORIZATION_AND_CAPTURE</type>

<paymentMethod>INTEROPERABLE_QR</paymentMethod>

<paymentCountry>CO</paymentCountry>

</transaction>

<isTest>false</isTest>

</request>

Response Example:

<response>

<code>SUCCESS</code>

<error xsi:nil="true" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" />

<transactionResponse>

<orderId>1438936173</orderId>

<transactionId>bccc494c-97bf-4b7b-84ec-a7e9dac15449</transactionId>

<state>PENDING</state>

<paymentNetworkResponseCode xsi:nil="true" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" />

<paymentNetworkResponseErrorMessage xsi:nil="true" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" />

<trazabilityCode>a7463eca-3197-4a7f-8928-fbc7ca6017ea</trazabilityCode>

<authorizationCode xsi:nil="true" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" />

<pendingReason>AWAITING_NOTIFICATION</pendingReason>

<responseCode>PENDING_TRANSACTION_CONFIRMATION</responseCode>

<errorCode xsi:nil="true" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" />

<responseMessage xsi:nil="true" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" />

<transactionDate xsi:nil="true" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" />

<transactionTime xsi:nil="true" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" />

<operationDate>1741780199019</operationDate>

<referenceQuestionnaire xsi:nil="true" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" />

<extraParameters>

<EXPIRATION_DATE>1742490236444</EXPIRATION_DATE>

<URL_PAYMENT_RECEIPT_PDF>http://ppp-web-gateway-payu.transactional.payu.preprod/ppp-web-gateway-payu/receipt?vid=1438936173Ybccc494c97bf4b7Y5f4bcef70c4d7b6</URL_PAYMENT_RECEIPT_PDF>

<QRCODE_IMAGE_BASE64>iVBORw0KGgoAAAANSUhEUgAAAJ4AAACeAQAAAADr/o7WAAAEG0lEQVR4Xn2XQYqjOwyEDd4KdBWDtwZfXaCtQFcxaCvQlPN2M/5faJLuD5K2paqS0urfR7a/SV0oLY96rhjU19nF2egNPb3x6LHdTsywYWVvaFQ1/JzJyZSHwuQT4gNGrDMikj34f2BsCunhkq0NSvqCntqnuk5eI2fFyN85H1Ca/fX43f0Bq06P4xa6WlaU/1fPBxTiIbO1tYPa9mwx1xtqHedR1ktOtVFl/gWT8Owtxt7cVWnKB7Teh5xjnc/IDGdxe0NfGw1xJllyNseZa71hTvyJS8bWUBqdU+gNqznXVp62Bxp3htL6gKH7GI/w1shPpfoHjDaXoNAsVglFtH7L94JV5CqxdPcTrtQW38a94Nni0Qf7WIfkTG3rA3aRLZEoXSTku+Ke8wUdqm6zZspV1gmOmW8IPy0V2/AMT1Y6Bv08oeY6Nd2moW8Dr9vpDYNnP1C1MhrDzUoh2yesRmvjiWIeOBfa5NujF3Q96a6+kzIVvdN8QydtcD6UsNLG0XVF+4TBEqPYqpakT2OWD+jCzK3xlN7a8Witf8BgNGOWoiYOMVDF/oBqshAsNfoqfIZDtPmGsttahbN36oqwQlTaG1ZjhBWc7yuLEZR8FfKCoSVm3jsjKgnZ9jvnC6Yd/B9Cw9bMrrZSPqD5gaA69I9A48A10eInrBOQt993zWLP0fVq/gF1qt2DByoYKB3cS2+IfsH7MadOZBAarTjSE4rXhrbPcrjm3oJvVD7h6ilw38HBahykqn9AWN944u0bHJbB2egNT1vJrQTF3koIP0KLn9A2xL2vo2++QuWR9oZHRrakWDLQN5lcPd/Qe66tQn0LKW868wuqMNUQDtk4nflunT6gSx+JJ1kr1+DtuMATJgbYPmS09PwKTD8tPSBcrQMjsoQwnw16uC5+wcBEhFXaYDmt3/Sjm8kPiAOd5ja41u4chnFCb2hDjBtCVW5o+ZSwLxiLcLvMmxg07sD6gIrJgD1GF4Y+ftcGQ3xAbAZatqbi4dPXtFvPBxRL3GBIbkwURJDfIfWESIcDnS4==</QRCODE_IMAGE_BASE64>

<URL_PAYMENT_RECEIPT_HTML>http://ppp-web-gateway-payu.transactional.payu.preprod/ppp-web-gateway-payu/app/v2?vid=1438936173Ybccc494c97bf4b7Y5f4bcef70c4d7b6</URL_PAYMENT_RECEIPT_HTML>

</extraParameters>

<additionalInfo xsi:nil="true" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" />

</transactionResponse>

</response>

Submit Transactions Using Bank Transfer (PSE)

This method lets you process the bank transfer payments of your customers. In Colombia, bank transfers are made through PSE, to perform an integration with this payment method, you need to create a Payment form following these steps:

- Include a PSE button making clear that your customer will use Proveedor de Servicios Electrónicos PSE.

- You can use the following names in Spanish:

- Débito desde cuenta corriente/ahorros

- Débito bancario PSE

- PSE

- Do not use any of the following names:

- Transferencia bancaria

- Débito de cuenta

- Tarjeta débito

-

Query the available bank list to show them to the payer. To query the bank list, refer to this method.

You must update the the bank list in your system once a day. -

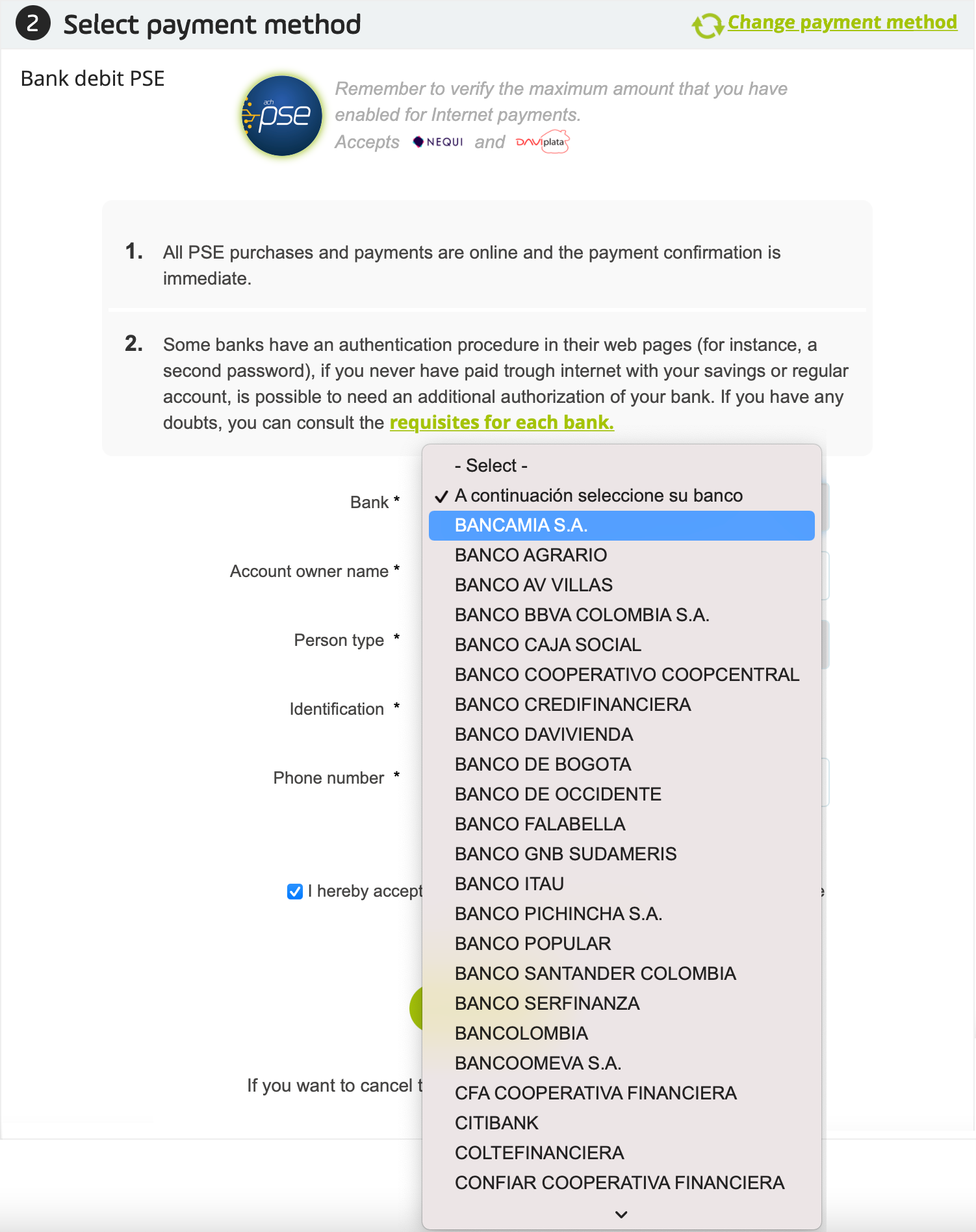

Show the list of banks as displayed below:

When the payer selects a bank, you must send the parameter pseCode of the selection in the extra parameter FINANCIAL_INSTITUTION_CODE in the request.

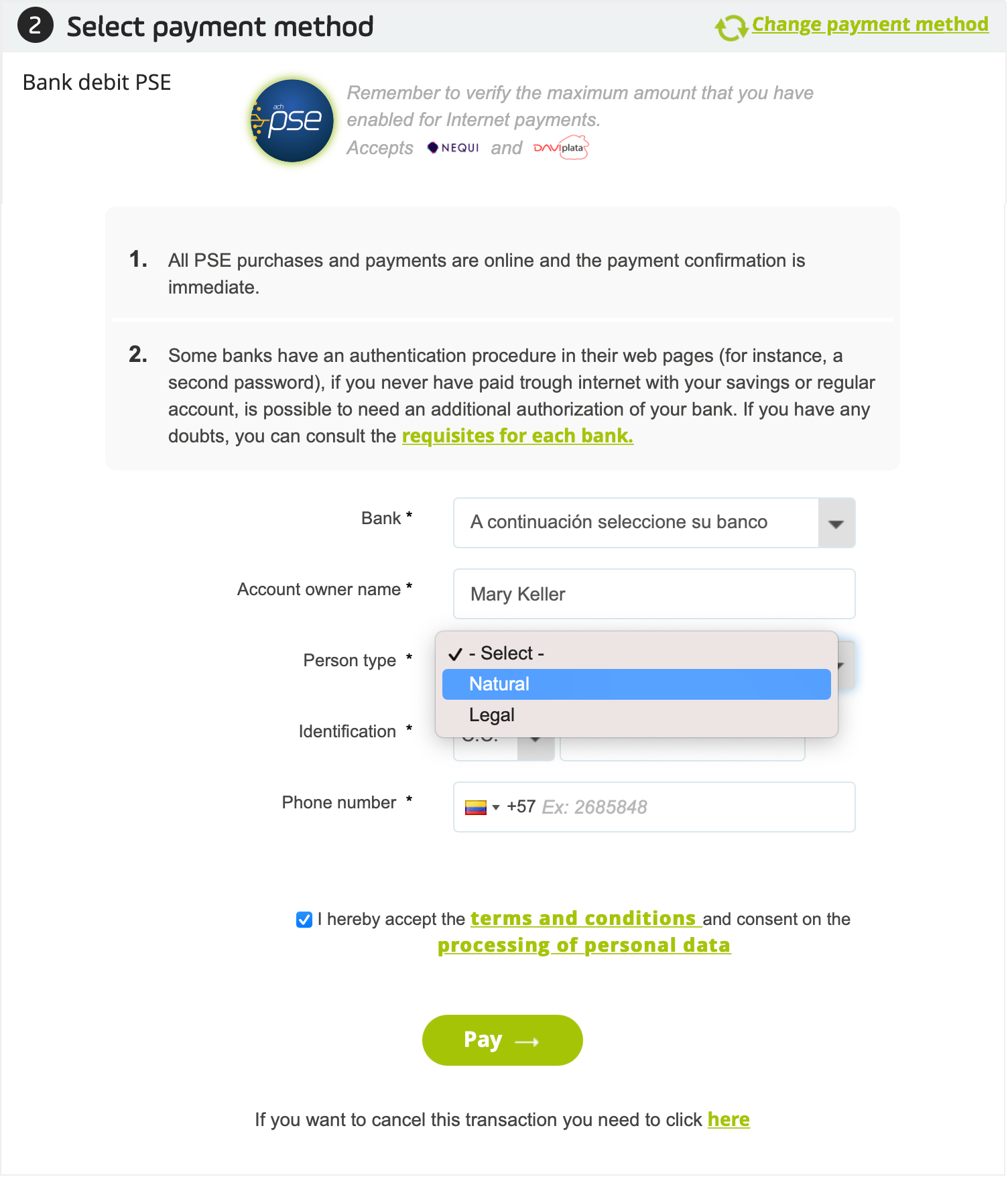

- Show a list to let the payer choose whether they are a Natural (N) or Legal (J) person. Depending on what the payer choose, you must send the value in the extra parameter

USER_TYPEin the request. The list must be displayed as follows:

Note

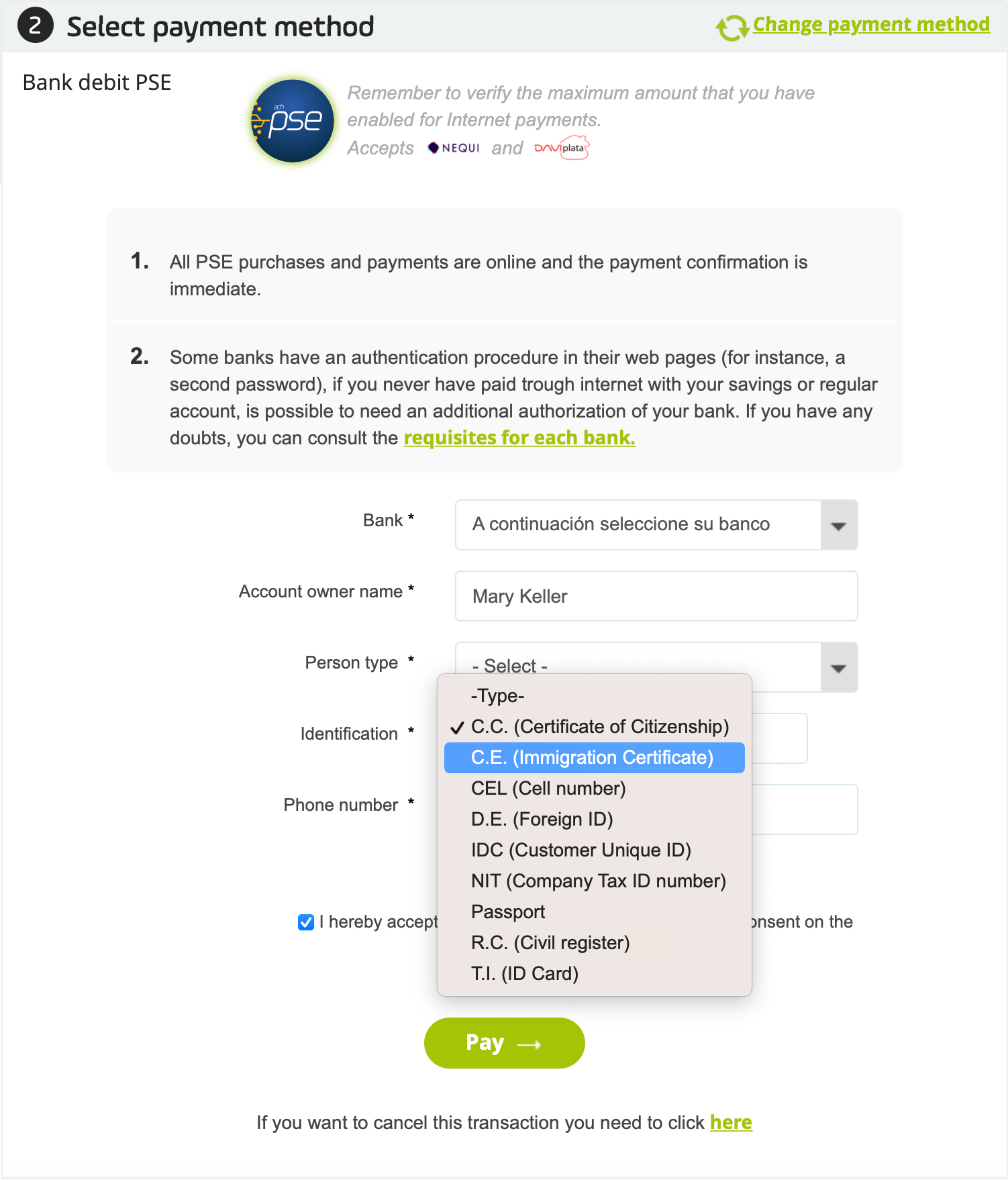

This field is not mandatory for PSE Avanza.- Show a list to let the payer choose their identification type. You must send the ISO code of the value selected in the extra parameter

PSE_REFERENCE2in the request. The list must be displayed as follows:

The list of available documents is:

| ISO | Description |

|---|---|

CC |

Citizenship card. |

CE |

Foreign citizenship card. |

NIT |

Tax identification number (Companies). |

TI |

Identity Card. |

PP |

Passport. |

RC |

Birth certificate. |

DE |

Foreign identification document. |

- You must send the payer identification number in the extra parameter

PSE_REFERENCE3in the request.

Parameters for Request and Response

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

language |

Alphanumeric | 2 | Language used in the request, this language is used to display the error messages generated. See supported languages. | Yes |

command |

Alphanumeric | Max:32 | Set SUBMIT_TRANSACTION. |

Yes |

test (JSON)isTest (XML) |

Boolean | Set true if the request is in test mode. Otherwise, set false. |

Yes | |

merchant |

Object | This object has the authentication data. | Yes | |

merchant > apiLogin |

Alphanumeric | Min:12 Max:32 | User or login provided by PayU. How do I get my API Login | Yes |

merchant > apiKey |

Alphanumeric | Min:6 Max:32 | Password provided by PayU. How do I get my API Key | Yes |

transaction |

Object | This object has the transaction data. | Yes | |

transaction > order |

Object | This object has the order data. | Yes | |

transaction > order > accountId |

Number | Identifier of your account. | Yes | |

transaction > order > referenceCode |

Alphanumeric | Min:1 Max:255 | Represents the identifier of the order in your system. | Yes |

transaction > order > description |

Alphanumeric | Min:1 Max:255 | Description of the order. | Yes |

transaction > order > language |

Alphanumeric | 2 | Language used in emails sent to the buyer and the seller. | Yes |

transaction > order > notifyUrl |

Alphanumeric | Max:2048 | Confirmation URL of the order. | No |

transaction > order > partnerId |

Alphanumeric | Max:255 | Partner ID in PayU. | No |

transaction > order > signature |

Alphanumeric | Max:255 | The signature associated to the form. For more information refer Authentication signature. | Yes |

transaction > order > shippingAddress |

Object | Shipping address. | No | |

transaction > order > shippingAddress > street1 |

Alphanumeric | Max:100 | Address Line 1. | No |

transaction > order > shippingAddress > street2 |

Alphanumeric | Max:100 | Address Line 2. | No |

transaction > order > shippingAddress > city |

Alphanumeric | Max:50 | Address city. | No |

transaction > order > shippingAddress > state |

Alphanumeric | Max:40 | Address State. | No |

transaction > order > shippingAddress > country |

Alphanumeric | 2 | Address country. | No |

transaction > order > shippingAddress > postalCode |

Alphanumeric | Max:8 | Address Zip code. | No |

transaction > order > shippingAddress > phone |

Alphanumeric | Max:11 | Phone number associated to the address. | No |

transaction > order > buyer |

Object | Buyer information. | Yes | |

transaction > order > buyer > merchantBuyerId |

Alphanumeric | Max:100 | Buyer ID in your system. | No |

transaction > order > buyer > fullName |

Alphanumeric | Max:150 | Full name of the buyer. | Yes |

transaction > order > buyer > emailAddress |

Alphanumeric | Max:255 | E-mail of the buyer. | Yes |

transaction > order > buyer > contactPhone |

Alphanumeric | Max:20 | Phone number of the buyer. | Yes |

transaction > order > buyer > dniNumber |

Alphanumeric | Max:20 | Identification number of the buyer. | Yes |

transaction > order > buyer > shippingAddress |

Alphanumeric | Shipping address of the buyer. | Yes | |

transaction > order > buyer > shippingAddress > street1 |

Alphanumeric | Max:150 | Buyer’s shipping address Line 1. | Yes |

transaction > order > buyer > shippingAddress > city |

Alphanumeric | Max:50 | Buyer’s shipping address city. | Yes |

transaction > order > buyer > shippingAddress > state |

Alphanumeric | Max:40 | Buyer’s shipping address state. | Yes |

transaction > order > buyer > shippingAddress > country |

Alphanumeric | 2 | Buyer’s shipping address country in format ISO 3166 alpha-2. | Yes |

transaction > order > buyer > shippingAddress > postalCode |

Number | Max:20 | Buyer’s shipping address zip code. | Yes |

transaction > order > buyer > shippingAddress > phone |

Number | Max:20 | Buyer’s shipping address phone number. | Yes |

transaction > order > additionalValues |

Object | 64 | Amount of the order or its associated values. | Yes |

transaction > order > additionalValues > TX_VALUE |

Alphanumeric | 64 | Amount of the transaction. | Yes |

transaction > order > additionalValues > TX_VALUE > value |

Number | 12, 2 | Specifies the amount of the transaction. This amount cannot include decimals. | Yes |

transaction > order > additionalValues > TX_VALUE > currency |

Alphanumeric | 3 | ISO code of the currency. See accepted currencies. | Yes |

transaction > payer |

Object | Payer information. | Yes | |

transaction > payer > emailAddress |

Alphanumeric | Max:255 | Payer e-mail address. | Yes |

transaction > payer > merchantPayerId |

Alphanumeric | Max:100 | Identifier of the payer in your system. | No |

transaction > payer > fullName |

Alphanumeric | Max:150 | Name of the payer. | Yes |

transaction > payer > billingAddress |

Object | Billing address. | Yes | |

transaction > payer > billingAddress > street1 |

Alphanumeric | Max:100 | Billing Address Line 1. | Yes |

transaction > payer > billingAddress > street2 |

Alphanumeric | Max:100 | Billing Address Line 2. | No |

transaction > payer > billingAddress > city |

Alphanumeric | Max:50 | Billing address city. | Yes |

transaction > payer > billingAddress > state |

Alphanumeric | Max:40 | Billing address state. | No |

transaction > payer > billingAddress > country |

Alphanumeric | 2 | Billing address country in format ISO 3166 Alpha-2. | Yes |

transaction > payer > billingAddress > postalCode |

Alphanumeric | Max:20 | Billing address zip code. | No |

transaction > payer > billingAddress > phone |

Alphanumeric | Max:20 | Billing address phone number. | No |

transaction > payer > birthdate |

Alphanumeric | Max:10 | Payer’s date of birth. | No |

transaction > payer > contactPhone |

Alphanumeric | Max:20 | Payer’s phone number. | Yes |

transaction > payer > dniNumber |

Alphanumeric | Max:20 | Identification number of the buyer. | Yes |

transaction > payer > dniType |

Alphanumeric | 2 | Identification type of the buyer. See Document types. | Yes |

transaction > type |

Alphanumeric | 32 | As these payments are performed in PSE webpage, la única transacción disponible es AUTHORIZATION_AND_CAPTURE |

Yes |

transaction > paymentMethod |

Alphanumeric | 32 | Select a valid Payment Method in bank transfer. See the available Payment Methods for Colombia. | Yes |

transaction > paymentCountry |

Alphanumeric | 2 | Set CO for Colombia. |

Yes |

transaction > deviceSessionId |

Alphanumeric | Max:255 | Session identifier of the device where the customer performs the transaction. For more information, refer to this topic. | Yes |

transaction > ipAddress |

Alphanumeric | Max:39 | IP address of the device where the customer performs the transaction. | Yes |

transaction > cookie |

Alphanumeric | Max:255 | Cookie stored by the device where the customer performs the transaction. | Yes |

transaction > userAgent |

Alphanumeric | Max:1024 | The User agent of the browser where the customer performs the transaction. | Yes |

transaction > extraParameters |

Object | Additional parameters or data associated with the request. For bank transfer payments, this is your merchant’s response page. In JSON, the extraParameters parameter is assigned as: "extraParameters": {"RESPONSE_URL": "http://www....","PSE_REFERENCE1": "example_value","FINANCIAL_INSTITUTION_CODE": "XXXX","USER_TYPE": "N","PSE_REFERENCE2": "example_value","PSE_REFERENCE3": "123456789"}Note: Keep in mind that for the "USER_TYPE" field, the allowed values are: "N" for natural person "J" for legal entity.In XML, the extraParameters parameter is assigned as: <extraParameters><entry><string>RESPONSE_URL</string><string>http://www....</string></entry><entry><string>PSE_REFERENCE1</string><string>example_value</string></entry><entry> <string>FINANCIAL_INSTITUTION_CODE</string><string>XXXX</string></entry><entry><string>USER_TYPE</string><string>N</string></entry><entry><string>PSE_REFERENCE2</string><string>example_value</string></entry><entry><string>PSE_REFERENCE3</string><string>123456789</string></entry></extraParameters>Note: Keep in mind that for the <string>USER_TYPE</string> field, the allowed values are: <string>N</string>: for natural person. <string>J</string>: for legal entity. |

Yes |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

code |

Alphanumeric | The response code of the transaction. Possible values are ERROR and SUCCESS. |

|

error |

Alphanumeric | Max:2048 | The error message associated when the response code is ERROR. |

transactionResponse |

Object | The response data. | |

transactionResponse > orderId |

Number | The generated or existing order Id in PayU. | |

transactionResponse > transactionId |

Alphanumeric | 36 | The identifier of the transaction in PayU. |

transactionResponse > state |

Alphanumeric | Max:32 | The status of the transaction. As the payment is performed by the user in a physical office, the state for a successful transaction is PENDING |

transactionResponse > paymentNetworkResponseCode |

Alphanumeric | Max:255 | The response code returned by the financial network. |

transactionResponse > paymentNetworkResponseErrorMessage |

Alphanumeric | Max:255 | The error message returned by the financial network. |

transactionResponse > trazabilityCode |

Alphanumeric | Max:32 | The traceability code returned by the financial network. |

transactionResponse > authorizationCode |

Alphanumeric | Max:12 | The authorization code returned by the financial network. |

transactionResponse > pendingReason |

Alphanumeric | Max:21 | The reason code associated with the status, as mentioned in transactionResponse > state, the transaction is waiting for the payment. |

transactionResponse > responseCode |

Alphanumeric | Max:64 | The response code associated with the status. In this case, for successful transactions is PENDING_TRANSACTION_CONFIRMATION. |

transactionResponse > responseMessage |

Alphanumeric | Max:2048 | Message associated with the response code. |

transactionResponse > operationDate |

Date | Creation date of the response in the PayU´s system. | |

transactionResponse > extraParameters |

Object | Additional parameters or data associated with the response. In JSON, the extraParameters parameter follows this structure: "extraParameters": {"BANK_URL": "xxxx"}In XML, the extraParameters parameter follows this structure: <extraParameters><entry><string>BANK_URL</string><string>xxxx</string></entry></extraParameters> |

Considerations

- To test PSE bank transfers in the PayU Sandbox environment, see the PSE Test Guide (PDF).

- All the payment process values must be formatted in thousands (i.e., 1,200.00 or 1,200) without exception.

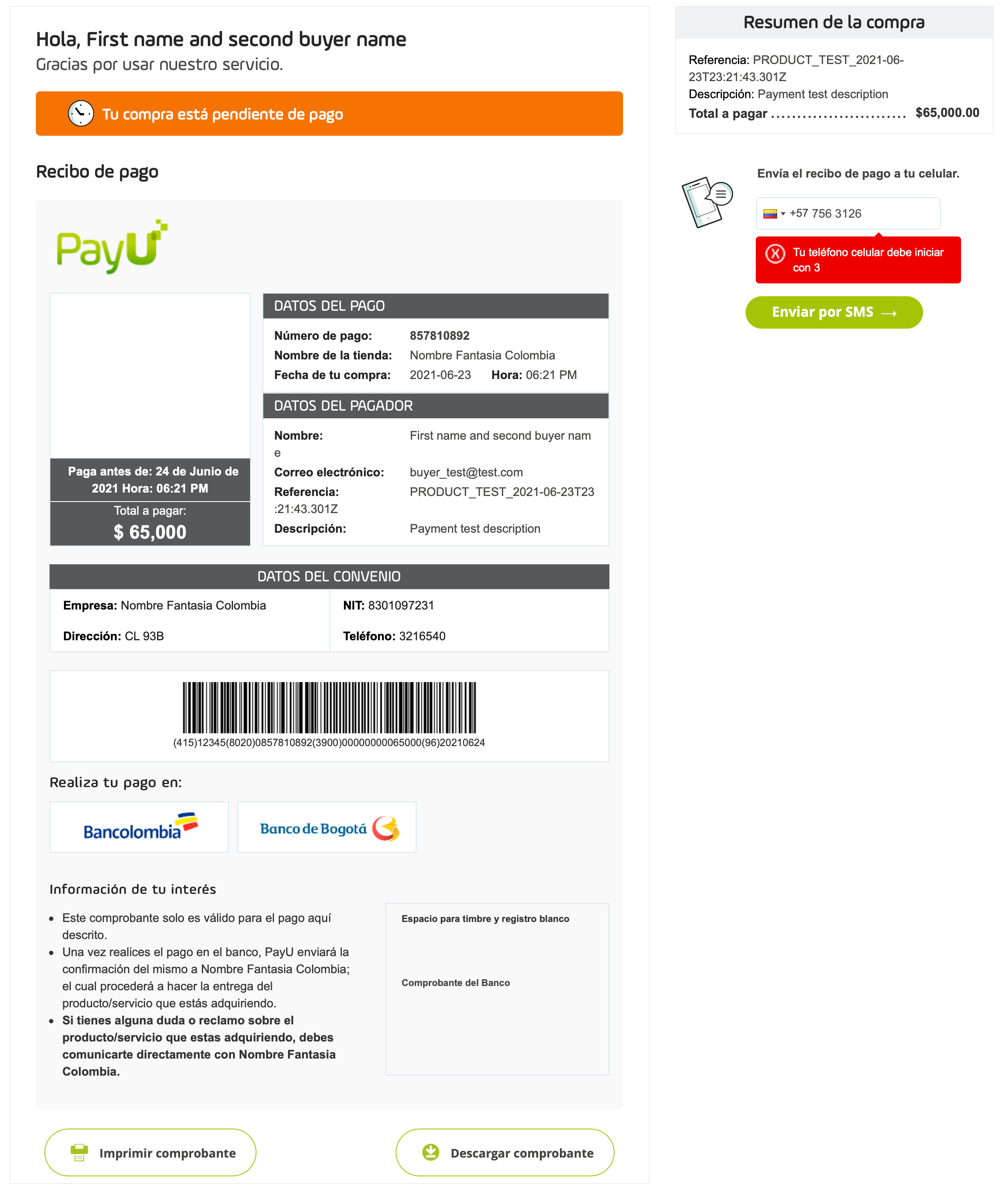

- If the payment request is successful, the transaction has state

PENDINGand responseCodePENDING_TRANSACTION_CONFIRMATION; this is because the payer is redirected to the selected bank to complete the payment; you must redirect the payer to the URL returned in the extra parameterBANK_URL. - The URL returned in the extra parameter

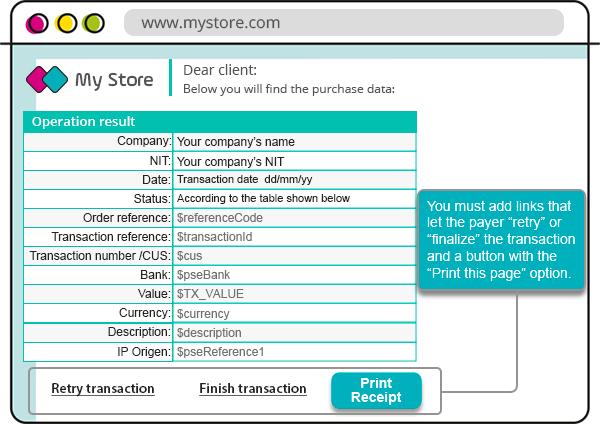

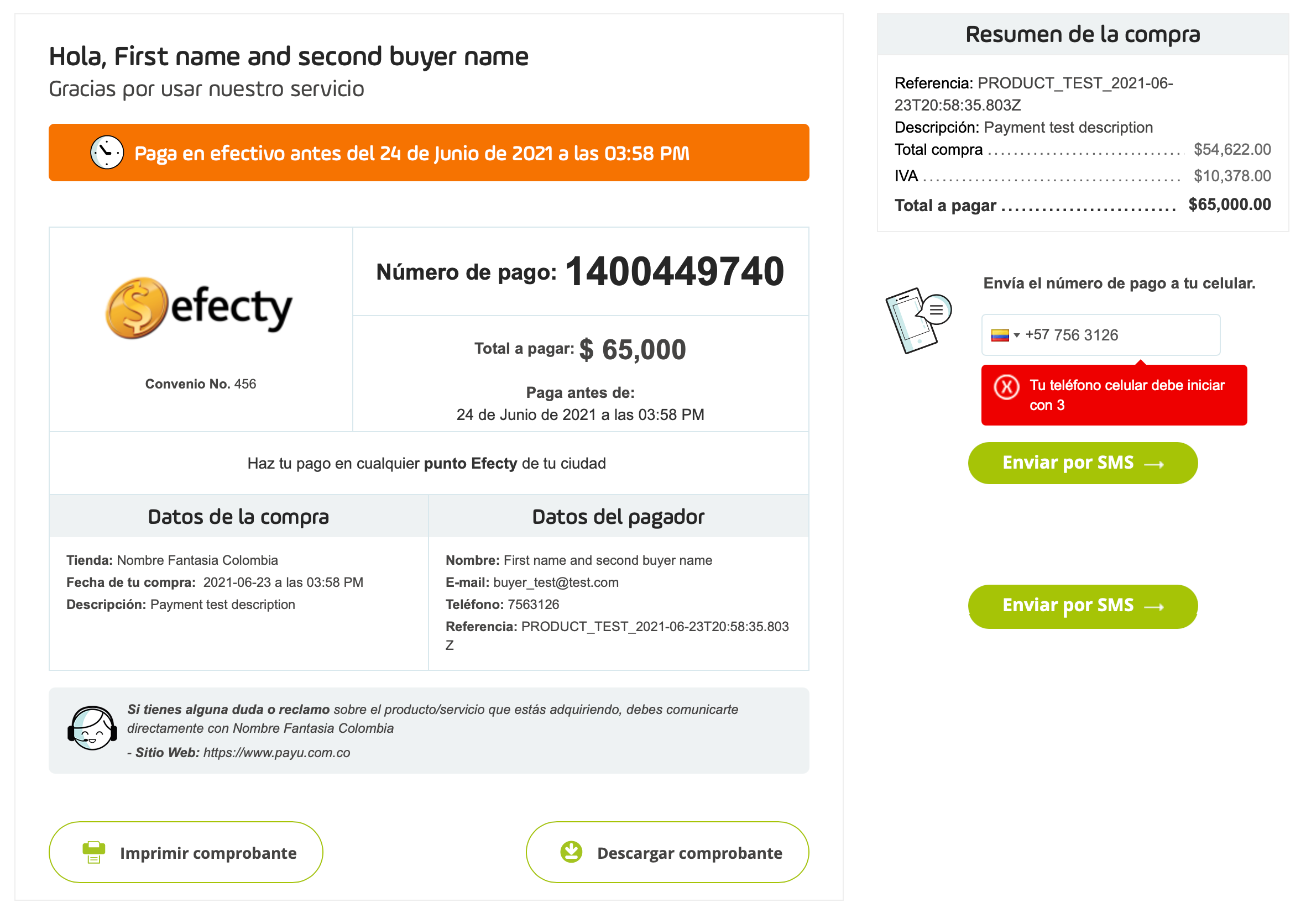

BANK_URLis configured in the PayU Module and must show the following information:

Parameters starting with $ symbol are sent viaGET. - Once the client clicks the Pay button, this must be disabled to avoid sending a new request over the same payment.

- It is recommended to display a wait message while your customer is redirected.

- Do not show the bank site in containers (frames, panel, iframes, etc). The payment process must be fluid. Furthermore, avoid opening the bank site in a new tab nor a new browser window. If you need to use a new tab or window, block the origin page to avoid sending a new request over the same payment.

- You must add in the response page the options to retry the payment, finish the transaction and print the receipt.

- The status displayed in the response page can be any of the following:

| polTransactionState | polResponseCode | State |

|---|---|---|

4 |

1 |

Approved transaction |

6 |

5 |

Failed transaction |

6 |

4 |

Rejected transaction |

12 or 14 |

9994 or 25 |

Pending transaction, please check if the debit was made in the bank. |

API Call

The following are the bodies of the request and response of this payment method.

Request Example:

{

"language": "es",

"command": "SUBMIT_TRANSACTION",

"merchant": {

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA",

"apiLogin": "pRRXKOl8ikMmt9u"

},

"transaction": {

"order": {

"accountId": "512321",

"referenceCode": "PRODUCT_TEST_2021-06-23T19:59:43.229Z",

"description": "Payment test description",

"language": "es",

"signature": "1d6c33aed575c4974ad5c0be7c6a1c87",

"notifyUrl": "http://www.payu.com/notify",

"additionalValues": {

"TX_VALUE": {

"value": 65000,

"currency": "COP"

},

"TX_TAX": {

"value": 10378,

"currency": "COP"

},

"TX_TAX_RETURN_BASE": {

"value": 54622,

"currency": "COP"

}

},

"buyer": {

"merchantBuyerId": "1",

"fullName": "First name and second buyer name",

"emailAddress": "buyer_test@test.com",

"contactPhone": "7563126",

"dniNumber": "123456789",

"shippingAddress": {

"street1": "Cr 23 No. 53-50",

"street2": "5555487",

"city": "Bogotá",

"state": "Bogotá D.C.",

"country": "CO",

"postalCode": "000000",

"phone": "7563126"

}

},

"shippingAddress": {

"street1": "Cr 23 No. 53-50",

"street2": "5555487",

"city": "Bogotá",

"state": "Bogotá D.C.",

"country": "CO",

"postalCode": "0000000",

"phone": "7563126"

}

},

"payer": {

"merchantPayerId": "1",

"fullName": "First name and second payer name",

"emailAddress": "payer_test@test.com",

"contactPhone": "7563126",

"dniNumber": "5415668464654",

"billingAddress": {

"street1": "Cr 23 No. 53-50",

"street2": "125544",

"city": "Bogotá",

"state": "Bogotá D.C.",

"country": "CO",

"postalCode": "000000",

"phone": "7563126"

}

},

"extraParameters": {

"RESPONSE_URL": "http://www.payu.com/response",

"PSE_REFERENCE1": "127.0.0.1",

"FINANCIAL_INSTITUTION_CODE": "1022",

"USER_TYPE": "N",

"PSE_REFERENCE2": "CC",

"PSE_REFERENCE3": "123456789"

},

"type": "AUTHORIZATION_AND_CAPTURE",

"paymentMethod": "PSE",

"paymentCountry": "CO",

"deviceSessionId": "vghs6tvkcle931686k1900o6e1",

"ipAddress": "127.0.0.1",

"cookie": "pt1t38347bs6jc9ruv2ecpv7o2",

"userAgent": "Mozilla/5.0 (Windows NT 5.1; rv:18.0) Gecko/20100101 Firefox/18.0"

},

"test": false

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"transactionResponse": {

"orderId": 1400449959,

"transactionId": "4d49e544-e23f-474e-92b1-59357e0e85e8",

"state": "PENDING",

"paymentNetworkResponseCode": null,

"paymentNetworkResponseErrorMessage": null,

"trazabilityCode": "2204682",

"authorizationCode": null,

"pendingReason": "AWAITING_NOTIFICATION",

"responseCode": "PENDING_TRANSACTION_CONFIRMATION",

"errorCode": null,

"responseMessage": null,

"transactionDate": null,

"transactionTime": null,

"operationDate": 1624471332753,

"referenceQuestionnaire": null,

"extraParameters": {

"TRANSACTION_CYCLE": "1",

"BANK_URL": "https://sandbox.api.payulatam.com/payments-api/pse-caller?enc=aHR0cHM6Ly9yZWdpc3Ryby5kZXNhcnJvbGxvLnBzZS5jb20uY28vUFNFVXNlclJlZ2lzdGVyL1N0YXJ0VHJhbnNhY3Rpb24uYXNweD9lbmM9dG5QY0pITUtsU25tUnBITThmQWJ1NHVWTmt6YW92Q0tWR2g0b0IxbEpkOXNEeGlSU2E5cXl1Uk5TUW5mbkxSdiMjcGF5ZXJfdGVzdEB0ZXN0LmNvbSMjMTIzNDU2Nzg5IyNDQw=="

},

"additionalInfo": {

"paymentNetwork": "PSE",

"rejectionType": "NONE",

"responseNetworkMessage": null,

"travelAgencyAuthorizationCode": null,

"cardType": null,

"transactionType": "AUTHORIZATION_AND_CAPTURE"

}

}

}

Request Example:

<request>

<language>es</language>

<command>SUBMIT_TRANSACTION</command>

<merchant>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

</merchant>

<transaction>

<order>

<accountId>512321</accountId>

<referenceCode>PRODUCT_TEST_2021-06-23T19:59:43.229Z</referenceCode>

<description>Payment test description</description>

<language>es</language>

<signature>1d6c33aed575c4974ad5c0be7c6a1c87</signature>

<notifyUrl>http://www.payu.com/notify</notifyUrl>

<additionalValues>

<entry>

<string>TX_VALUE</string>

<additionalValue>

<value>65000</value>

<currency>COP</currency>

</additionalValue>

<string>TX_TAX</string>

<additionalValue>

<value>10378</value>

<currency>COP</currency>

</additionalValue>

<string>TX_TAX_RETURN_BASE</string>

<additionalValue>

<value>54622</value>

<currency>COP</currency>

</additionalValue>

</entry>

</additionalValues>

<buyer>

<merchantBuyerId>1</merchantBuyerId>

<fullName>First name and second buyer name</fullName>

<emailAddress>buyer_test@test.com</emailAddress>

<contactPhone>7563126</contactPhone>

<dniNumber>123456789</dniNumber>

<shippingAddress>

<street1>Cr 23 No. 53-50</street1>

<street2>5555487</street2>

<city>Bogotá</city>

<state>Bogotá D.C.</state>

<country>CO</country>

<postalCode>000000</postalCode>

<phone>7563126</phone>

</shippingAddress>

</buyer>

<shippingAddress>

<street1>Cr 23 No. 53-50</street1>

<street2>5555487</street2>

<city>Bogotá</city>

<state>Bogotá D.C.</state>

<country>CO</country>

<postalCode>0000000</postalCode>

<phone>7563126</phone>

</shippingAddress>

</order>

<payer>

<merchantPayerId>1</merchantPayerId>

<fullName>First name and second payer name</fullName>

<emailAddress>payer_test@test.com</emailAddress>

<contactPhone>7563126</contactPhone>

<dniNumber>5415668464654</dniNumber>

<billingAddress>

<street1>Cr 23 No. 53-50</street1>

<street2>5555487</street2>

<city>Bogotá</city>

<state>Bogotá D.C.</state>

<country>CO</country>

<postalCode>000000</postalCode>

<phone>7563126</phone>

</billingAddress>

</payer>

<extraParameters>

<entry>

<string>RESPONSE_URL</string>

<string>http://www.payu.com/response</string>

</entry>

<entry>

<string>PSE_REFERENCE1</string>

<string>127.0.0.1</string>

</entry>

<entry>

<string>FINANCIAL_INSTITUTION_CODE</string>

<string>1022</string>

</entry>

<entry>

<string>USER_TYPE</string>

<string>N</string>

</entry>

<entry>

<string>PSE_REFERENCE2</string>

<string>CC</string>

</entry>

<entry>

<string>PSE_REFERENCE3</string>

<string>123456789</string>

</entry>

</extraParameters>

<type>AUTHORIZATION_AND_CAPTURE</type>

<paymentMethod>PSE</paymentMethod>

<paymentCountry>CO</paymentCountry>

<deviceSessionId>vghs6tvkcle931686k1900o6e1</deviceSessionId>

<ipAddress>127.0.0.1</ipAddress>

<cookie>pt1t38347bs6jc9ruv2ecpv7o2</cookie>

<userAgent>Mozilla/5.0 (Windows NT 5.1; rv:18.0) Gecko/20100101 Firefox/18.0</userAgent>

</transaction>

<isTest>false</isTest>

</request>

Response Example:

<paymentResponse>

<code>SUCCESS</code>

<transactionResponse>

<orderId>1400449974</orderId>

<transactionId>6c99b11b-fe6f-4270-8c9a-dfc35b7c7e34</transactionId>

<state>PENDING</state>

<trazabilityCode>2204695</trazabilityCode>

<pendingReason>AWAITING_NOTIFICATION</pendingReason>

<responseCode>PENDING_TRANSACTION_CONFIRMATION</responseCode>

<operationDate>2021-06-23T13:12:14</operationDate>

<extraParameters>

<entry>

<string>TRANSACTION_CYCLE</string>

<string>1</string>

</entry>

<entry>

<string>BANK_URL</string>

<string>https://sandbox.api.payulatam.com/payments-api/pse-caller?enc=aHR0cHM6Ly9yZWdpc3Ryby5kZXNhcnJvbGxvLnBzZS5jb20uY28vUFNFVXNlclJlZ2lzdGVyL1N0YXJ0VHJhbnNhY3Rpb24uYXNweD9lbmM9dG5QY0pITUtsU25tUnBITThmQWJ1NHVWTmt6YW92Q0tWR2g0b0IxbEpkJTJmSGhQT0oyU2t4UnRmOEdLTk5tcGNYIyNwYXllcl90ZXN0QHRlc3QuY29tIyMxMjM0NTY3ODkjI0ND</string>

</entry>

</extraParameters>

<additionalInfo>

<paymentNetwork>PSE</paymentNetwork>

<rejectionType>NONE</rejectionType>

<transactionType>AUTHORIZATION_AND_CAPTURE</transactionType>

</additionalInfo>

</transactionResponse>

</paymentResponse>

Banks List for PSE

This method returns a list of the banks available for payments using PSE.

Parameters for Request and Response

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

language |

Alphanumeric | 2 | Language used in the request, this language is used to display the error messages generated. See supported languages. | Yes |

command |

Alphanumeric | Max:32 | Set GET_BANKS_LIST. |

Yes |

test (JSON)isTest (XML) |

Boolean | Set true if the request is in test mode. Otherwise, set false. |

Yes | |

merchant |

Object | This object has the authentication data. | Yes | |

merchant > apiLogin |

Alphanumeric | Min:12 Max:32 | User or login provided by PayU. How do I get my API Login | Yes |

merchant > apiKey |

Alphanumeric | Min:6 Max:32 | Password provided by PayU. How do I get my API Key | Yes |

bankListInformation |

Object | This object has the information of the query. | Yes | |

bankListInformation > paymentMethod |

Alphanumeric | Set PSE. |

Yes | |

bankListInformation > paymentCountry |

Alphanumeric | Set CO. |

Yes |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

code |

Alphanumeric | The response code of the transaction. Possible values are ERROR and SUCCESS. |

|

error |

Alphanumeric | Max:2048 | The error message associated when the response code is ERROR. |

banks |

Object | List of the banks available in PSE. | |

banks > id |

Numeric | Internal bank identifier. | |

banks > description |

Alphanumeric | Bank name to be displayed in the list. | |

banks > pseCode |

Alphanumeric | Code to send in the extra parameter FINANCIAL_INSTITUTION_CODE of the payment request. |

API Call

The following are the examples of the request and response of this method.

Request Example:

{

"language": "es",

"command": "GET_BANKS_LIST",

"merchant": {

"apiLogin": "pRRXKOl8ikMmt9u",

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA"

},

"test": false,

"bankListInformation": {

"paymentMethod": "PSE",

"paymentCountry": "CO"

}

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"banks": [

{

"id": "d9280852-47a5-4e99-94ac-3d7648ba79a3",

"description": "BANCO AGRARIO",

"pseCode": "1040"

},

{

"id": "6e61a91d-58bf-46ec-aa09-1f44974dda7e",

"description": "BANCO CAJA SOCIAL",

"pseCode": "10322"

},

{

"id": "b1de44f1-cede-4aca-9d3f-3313d5cc0c63",

"description": "BANCO DAVIVIENDA",

"pseCode": "1051"

},

{

"id": "ed06f40e-a1b9-4e48-8851-bffb4cda0480",

"description": "BANCO DE BOGOTA",

"pseCode": "1039"

},

{

"id": "55f59084-cd3b-47d2-a420-6442cdb9e4b1",

"description": "BANCO DE OCCIDENTE",

"pseCode": "1023"

},

{

"id": "8e134fca-4fde-44e6-b012-55e8f2d338ca",

"description": "BANCO FALABELLA",

"pseCode": "1062"

},

{

"id": "8eb03abf-5608-419b-8d2c-9d90b8ab6b88",

"description": "BANCO GNB COLOMBIA (ANTES HSBC)",

"pseCode": "1010"

},

{

"id": "283e0068-749f-43f1-a2e5-340910f41af3",

"description": "BANCO GNB SUDAMERIS",

"pseCode": "1012"

},

{

"id": "8b0bf5e7-394d-4f7e-a467-e4d21d04c9fb",

"description": "BANCO PICHINCHA S.A.",

"pseCode": "1060"

},

{

"id": "beeb494a-4ce5-41b4-b497-0756f0b6a6d9",

"description": "BANCO POPULAR",

"pseCode": "1002"

},

{

"id": "201acc05-4c4f-49dc-9be6-3261a6ce4a3c",

"description": "RAPPIPAY",

"pseCode": "1151"

}

]

}

Request Example:

<request>

<language>en</language>

<command>GET_BANKS_LIST</command>

<merchant>