Voids and Refunds API

VOID or REFUND methods.URLs

To integrate with the Voids and Refunds API, direct your requests to the appropriate environment URL:

- Test:

https://sandbox.api.payulatam.com/payments-api/4.0/service.cgi - Production:

https://api.payulatam.com/payments-api/4.0/service.cgi

For a deeper understanding of voids and refunds, including key concepts and considerations, refer to this document.

Considerations per Country

Before using the Voids and Refunds API, keep in mind the following country-specific considerations.

Argentina

Argentina

| Voids | Refunds |

|---|---|

|

|

Brazil

Brazil

| Voids | Refunds |

|---|---|

|

|

Chile

Chile

| Voids | Refunds |

|---|---|

|

|

Colombia

Colombia

| Voids | Refunds |

|---|---|

|

|

Mexico

Mexico

| Voids | Refunds |

|---|---|

|

|

Panama

Panama

| Voids | Refunds |

|---|---|

|

|

Peru

Peru

| Voids | Refunds |

|---|---|

|

|

Void

The VOID method cancels a previously authorized transaction. This is an automatic process—as soon as the system submits a VOID request, it does not follow any approval flow, and the integration will not charge the transaction to the cardholder.

Parameters for Request and Response

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

language |

Alphanumeric | 2 | Language used in the request. This determines the language of error messages. See supported languages. | Yes |

command |

Alphanumeric | Max: 32 | Set to SUBMIT_TRANSACTION. |

Yes |

test (JSON)isTest (XML) |

Boolean | — | Set to true for test mode; otherwise, false. |

Yes |

merchant |

Object | — | Contains authentication data. | Yes |

merchant > apiLogin |

Alphanumeric | Min: 12, Max: 32 | User or login provided by PayU. How to get API Login. | Yes |

merchant > apiKey |

Alphanumeric | Min: 6, Max: 32 | Password provided by PayU. How to get API Key. | Yes |

transaction |

Object | — | Contains transaction data. | Yes |

transaction > order |

Object | — | Contains order details. | Yes |

transaction > order > id |

Number | — | ID of the order to be voided. | Yes |

transaction > type |

Alphanumeric | 32 | Set to VOID to cancel an authorized transaction. |

Yes |

transaction > reason |

Alphanumeric | — | Reason for voiding the transaction. | No |

transaction > parentTransactionId |

Alphanumeric | 36 | ID of the transaction to be voided. | Yes |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

code |

Alphanumeric | — | Response code of the transaction. Possible values: ERROR, SUCCESS. |

error |

Alphanumeric | Max: 2048 | Error message when the response code is ERROR. |

transactionResponse |

Object | — | Contains response details. |

transactionResponse > orderId |

Number | — | The generated or existing order ID in PayU. |

transactionResponse > transactionId |

Alphanumeric | 36 | PayU transaction ID. |

transactionResponse > state |

Alphanumeric | Max: 32 | Status of the transaction. |

transactionResponse > paymentNetworkResponseCode |

Alphanumeric | Max: 255 | Response code from the financial network. |

transactionResponse > paymentNetworkResponseErrorMessage |

Alphanumeric | Max: 255 | Error message from the financial network. |

transactionResponse > trazabilityCode |

Alphanumeric | Max: 32 | Traceability code from the financial network. |

transactionResponse > authorizationCode |

Alphanumeric | Max: 12 | Authorization code from the financial network. |

transactionResponse > responseCode |

Alphanumeric | Max: 64 | Response code related to the transaction status. |

transactionResponse > responseMessage |

Alphanumeric | Max: 2048 | Message related to the response code. |

transactionResponse > operationDate |

Date | — | Date when the response was generated in the PayU system. |

API Call

The following examples show the request and response bodies for this transaction type.

Request Example:

{

"language": "es",

"command": "SUBMIT_TRANSACTION",

"merchant": {

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA",

"apiLogin": "pRRXKOl8ikMmt9u"

},

"transaction": {

"order": {

"id": "1400462414"

},

"type": "VOID",

"reason": "Reason for requesting the void of the transaction",

"parentTransactionId": "c8ec8737-7645-4756-a991-6e60a99eb4d9"

},

"test": false

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"transactionResponse": {

"orderId": 1400462414,

"transactionId": "57546e0a-8275-48e3-af11-7d3dc7420bfe",

"state": "APPROVED",

"paymentNetworkResponseCode": "0",

"paymentNetworkResponseErrorMessage": null,

"trazabilityCode": "49263990",

"authorizationCode": "NPS-011111",

"pendingReason": null,

"responseCode": "APPROVED",

"errorCode": null,

"responseMessage": "APROBADA - Autorizada",

"transactionDate": null,

"transactionTime": null,

"operationDate": 1624880273010,

"referenceQuestionnaire": null,

"extraParameters": null,

"additionalInfo": null

}

}

Request Example:

<request>

<language>es</language>

<command>SUBMIT_TRANSACTION</command>

<merchant>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

</merchant>

<transaction>

<order>

<id>1400462466</id>

</order>

<type>VOID</type>

<parentTransactionId>50876ad6-46f2-4c8d-bb91-2f028b56ccb8</parentTransactionId>

</transaction>

<isTest>false</isTest>

</request>

Response Example:

<paymentResponse>

<code>SUCCESS</code>

<transactionResponse>

<orderId>1400462466</orderId>

<transactionId>5fbb1ab0-3d2e-448f-a0be-b0bcfb5501ae</transactionId>

<state>APPROVED</state>

<paymentNetworkResponseCode>0</paymentNetworkResponseCode>

<trazabilityCode>49263990</trazabilityCode>

<authorizationCode>NPS-011111</authorizationCode>

<responseCode>APPROVED</responseCode>

<responseMessage>APROBADA - Autorizada</responseMessage>

<operationDate>2021-06-28T06:57:44</operationDate>

</transactionResponse>

</paymentResponse>

Refunds

A refund is issued when a merchant voluntarily returns the payment to the shopper. This can happen due to customer dissatisfaction or when the product is out of stock. The REFUND method reverses a previously captured transaction.

Refunds can be issued for the full amount or as a partial refund (PARTIAL_REFUND).

Refund Capabilities per Payment Method and Country

The following tables summarize the refund behavior observed for different payment methods across Latam. Each section shows whether a payment method supports total refunds, partial refunds, and multiple partial refunds, including the maximum number of partial refunds identified during testing.

Argentina

Argentina

| Payment Method | Total Refund Supported | Partial Refund Supported | Multiple Partial Refunds Supported | Maximum Partial Refunds | Notes |

|---|---|---|---|---|---|

| AMEX | ✅ Yes | ✅ Yes | ✅ Yes | 7 | Both domestic and international AMEX (credit) support multiple partial refunds; AMEX debit supports only a single partial refund. |

| ARGENCARD | ✅ Yes | ✅ Yes | ✅ Yes | 2 | Supports up to 2 partial refunds (domestic transactions). |

| CABAL | ✅ Yes | ✅ Yes | ✅ Yes | 3 | Support for multiple partial refunds, both for debit and credit. |

| MASTERCARD | ✅ Yes | ✅ Yes | ✅ Yes | 14 | Support for multiple partial refunds across debit and credit; prepaid supports single partial refund only. |

| MASTERCARD_PREPAID | ✅ Yes | ✅ Yes | ❌ No | 1 | Only single partial refunds supported. |

| NARANJA | ✅ Yes | ✅ Yes | ✅ Yes | 3 | Multiple partial refunds supported for debit and credit. |

| VISA | ✅ Yes | ✅ Yes | ✅ Yes | 22 | Multiple partial refunds allowed for debit, credit, and prepaid. |

| VISA_PREPAID | ✅ Yes | ✅ Yes | ❌ No | 1 | Only single partial refunds supported. |

Brazil

Brazil

| Payment Method | Total Refund Supported | Partial Refund Supported | Multiple Partial Refunds Supported | Maximum Partial Refunds | Notes |

|---|---|---|---|---|---|

| AMEX | ✅ Yes | ✅ Yes | ✅ Yes | 3 | Support for partial and multiple partial refunds for credit transactions. |

| ELO | ✅ Yes | ✅ Yes | ✅ Yes | 5 | Multiple partial refunds supported for both credit and debit transactions. |

| HIPERCARD | ✅ Yes | ✅ Yes | ✅ Yes | 2 | Debit transactions allow up to 2 partial refunds. |

| MASTERCARD | ✅ Yes | ✅ Yes | ✅ Yes | 5 | Multiple partial refunds supported (domestic transactions). |

| PIX | ✅ Yes | ✅ Yes | ✅ Yes | 7 | Support for multiple partial refunds. |

| VISA | ✅ Yes | ✅ Yes | ✅ Yes | 11 | Consistent support for multiple partial refunds across all card types (credit and debit). |

Chile

Chile

| Payment Method | Total Refund Supported | Partial Refund Supported | Multiple Partial Refunds Supported | Maximum Partial Refunds | Notes |

|---|---|---|---|---|---|

| AMEX | ✅ Yes | ✅ Yes | ✅ Yes | 5 | Support for both domestic and international credit transactions. |

| MASTERCARD | ✅ Yes | ✅ Yes | ✅ Yes | 10 | Fully supports multiple partial refunds across all card types. |

| MASTERCARD_PREPAID | ✅ Yes | ✅ Yes | ✅ Yes | 2 | Multiple partial refunds supported for debit transactions. |

| VISA | ✅ Yes | ✅ Yes | ✅ Yes | 9 | Multiple partial refunds supported across all card types; both domestic and international transactions confirmed. |

| VISA_PREPAID | ✅ Yes | ✅ Yes | ✅ Yes | 2 | Multiple partial refunds supported for debit transactions. |

Colombia

Colombia

| Payment Method | Features |

|---|---|

| AMEX DINERS MASTERCARD MASTERCARD_DEBIT VISA VISA_DEBIT VISA_NFC CODENSA |

✅ Total Refund Supported: Yes ✅ Partial Refund Supported: Yes ❌ Multiple Partial Refunds Supported: No Maximum Partial Refunds: 1 Note: Only a single partial refund is supported for all payment methods. |

Mexico

Mexico

| Payment Method | Total Refund Supported | Partial Refund Supported | Multiple Partial Refunds Supported | Maximum Partial Refunds | Notes |

|---|---|---|---|---|---|

| AMEX | ✅ Yes | ✅ Yes | ✅ Yes | 7 | AMEX supports multiple partial refunds for both domestic and international credit cards (up to 7). Debit cards only support a single partial refund. |

| MASTERCARD | ✅ Yes | ✅ Yes | ✅ Yes | 7 | Support for multiple partial refunds for both credit and debit cards. |

| VISA | ✅ Yes | ✅ Yes | ✅ Yes | 10 | Support for multiple partial refunds for both credit and debit cards. |

Peru

Peru

| Payment Method | Total Refund Supported | Partial Refund Supported | Multiple Partial Refunds Supported | Maximum Partial Refunds | Notes |

|---|---|---|---|---|---|

| AMEX | ✅ Yes | ✅ Yes | ✅ Yes | 8 | Multiple partial refunds supported. |

| DINERS | ✅ Yes | ✅ Yes | ✅ Yes | 7 | Domestic transactions support multiple partial refunds; international only allows a single partial refund. |

| MASTERCARD | ✅ Yes | ✅ Yes | ✅ Yes | 8 | Multiple partial refunds supported. |

| MASTERCARD_DEBIT | ✅ Yes | ✅ Yes | ✅ Yes | 8 | Multiple partial refunds supported. |

| VISA | ✅ Yes | ✅ Yes | ✅ Yes | 17 | Multiple partial refunds supported. |

| VISA_DEBIT | ✅ Yes | ✅ Yes | ✅ Yes | 12 | Multiple partial refunds supported. |

| YAPE | ✅ Yes | ✅ Yes | ✅ Yes | 2 | Multiple partial refunds supported. |

Parameters for Request and Response

Request

| Field Name | Format | Size | Description | Mandatory |

|---|---|---|---|---|

language |

Alphanumeric | 2 | Language used in the request. This determines the language of error messages. See supported languages. | Yes |

command |

Alphanumeric | Max: 32 | Set to SUBMIT_TRANSACTION. |

Yes |

test (JSON)isTest (XML) |

Boolean | — | Set to true for test mode; otherwise, false. |

Yes |

merchant |

Object | — | Contains authentication data. | Yes |

merchant > apiLogin |

Alphanumeric | Min: 12, Max: 32 | User or login provided by PayU. How to get API Login. | Yes |

merchant > apiKey |

Alphanumeric | Min: 6, Max: 32 | Password provided by PayU. How to get API Key. | Yes |

transaction |

Object | — | Contains transaction data. | Yes |

transaction > additionalValues |

Object | — | Specifies the amount for a partial refund. Required for partial refunds. | No |

transaction > additionalValues > TX_VALUE |

Object | — | Contains the transaction amount details. Required for partial refunds. | No |

transaction > additionalValues > TX_VALUE > value |

Number | Max: 19 | Amount to be refunded. Required for partial refunds. | No |

transaction > additionalValues > TX_VALUE > currency |

Alphanumeric | 3 | ISO currency code. See accepted currencies. Required for partial refunds. | No |

transaction > order |

Object | — | Contains order details. | Yes |

transaction > order > id |

Number | — | ID of the order to be refunded. | Yes |

transaction > type |

Alphanumeric | 32 | Specifies the type of refund: - REFUND for full refunds.- PARTIAL_REFUND for partial refunds (if supported). |

Yes |

transaction > reason |

Alphanumeric | — | Reason for issuing the refund. | No |

transaction > parentTransactionId |

Alphanumeric | 36 | ID of the original transaction being refunded. | Yes |

Response

| Field Name | Format | Size | Description |

|---|---|---|---|

code |

Alphanumeric | — | Response code for the transaction. Possible values: ERROR, SUCCESS. |

error |

Alphanumeric | Max: 2048 | Error message when the response code is ERROR. |

transactionResponse |

Object | — | Contains response details. |

transactionResponse > orderId |

Number | — | The generated or existing order ID in PayU. |

transactionResponse > transactionId |

Alphanumeric | 36 | PayU transaction ID. |

transactionResponse > state |

Alphanumeric | Max: 32 | Transaction status. |

transactionResponse > paymentNetworkResponseCode |

Alphanumeric | Max: 255 | Response code from the financial network. |

transactionResponse > paymentNetworkResponseErrorMessage |

Alphanumeric | Max: 255 | Error message from the financial network. |

transactionResponse > trazabilityCode |

Alphanumeric | Max: 32 | Traceability code from the financial network. |

transactionResponse > authorizationCode |

Alphanumeric | Max: 12 | Authorization code from the financial network. |

transactionResponse > responseCode |

Alphanumeric | Max: 64 | Response code associated with the transaction status. |

transactionResponse > responseMessage |

Alphanumeric | Max: 2048 | Message associated with the response code. |

transactionResponse > operationDate |

Date | — | Date when the response was generated in the PayU system. |

API Call

The following examples show the request and response bodies for this transaction type.

Refund Request Example:

{

"language": "es",

"command": "SUBMIT_TRANSACTION",

"merchant": {

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA",

"apiLogin": "pRRXKOl8ikMmt9u"

},

"transaction": {

"order": {

"id": "1400462687"

},

"type": "REFUND",

"reason": "Reason for requesting the refund of the transaction",

"parentTransactionId": "60e2080d-08b1-4db2-a54f-8bcbe8271662"

},

"test": false

}

Partial Refund Request Example:

{

"command":"SUBMIT_TRANSACTION",

"language":"es",

"merchant":{

"apiKey": "4Vj8eK4rloUd272L48hsrarnUA",

"apiLogin": "pRRXKOl8ikMmt9u"

},

"transaction":{

"additionalValues":{

"TX_VALUE":{

"value":"950",

"currency":"ARS"

}

},

"order":{

"id":"1400462690"

},

"parentTransactionId":"0486359b-a048-4b6b-9b72-af584e710e64",

"reason":"Reason for requesting the refund of the transaction",

"type":"PARTIAL_REFUND"

}

}

Response Example:

{

"code": "SUCCESS",

"error": null,

"transactionResponse": {

"orderId": 1400462690,

"transactionId": null,

"state": "PENDING",

"paymentNetworkResponseCode": null,

"paymentNetworkResponseErrorMessage": null,

"trazabilityCode": null,

"authorizationCode": null,

"pendingReason": "PENDING_REVIEW",

"responseCode": null,

"errorCode": null,

"responseMessage": "1400462690",

"transactionDate": null,

"transactionTime": null,

"operationDate": null,

"referenceQuestionnaire": null,

"extraParameters": null,

"additionalInfo": null

}

}

Refund Request Example:

<request>

<language>es</language>

<command>SUBMIT_TRANSACTION</command>

<merchant>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

</merchant>

<transaction>

<order>

<id>1400462689</id>

</order>

<type>REFUND</type>

<reason>Reason for requesting the refund of the transaction.</reason>

<parentTransactionId>1d31ea44-0d8f-4e65-93ac-6be4347e5b40</parentTransactionId>

</transaction>

<isTest>false</isTest>

</request>

Partial Refund Request Example:

<request>

<command>SUBMIT_TRANSACTION</command>

<language>es</language>

<merchant>

<apiKey>4Vj8eK4rloUd272L48hsrarnUA</apiKey>

<apiLogin>pRRXKOl8ikMmt9u</apiLogin>

</merchant>

<transaction>

<additionalValues>

<entry>

<string>TX_VALUE</string>

<additionalValue>

<value>950</value>

<currency>ARS</currency>

</additionalValue>

</entry>

</additionalValues>

<order>

<id>1400462690</id>

</order>

<parentTransactionId>0486359b-a048-4b6b-9b72-af584e710e64</parentTransactionId>

<reason>Reason for requesting the refund of the transaction</reason>

<type>PARTIAL_REFUND</type>

</transaction>

</request>

Response Example:

<paymentResponse>

<code>SUCCESS</code>

<transactionResponse>

<orderId>1400462691</orderId>

<transactionId>6cef020a-8006-4744-b7f9-d9a343807297</transactionId>

<state>PENDING</state>

<pendingReason>PENDING_REVIEW</pendingReason>

<responseMessage>1400462690</responseMessage>

</transactionResponse>

</paymentResponse>

Querying the Refund Status

As mentioned earlier, refund requests go through an approval process. PayU usually takes 1 to 3 days to review and either approve or reject the request. You can check the refund status using one of the following methods:

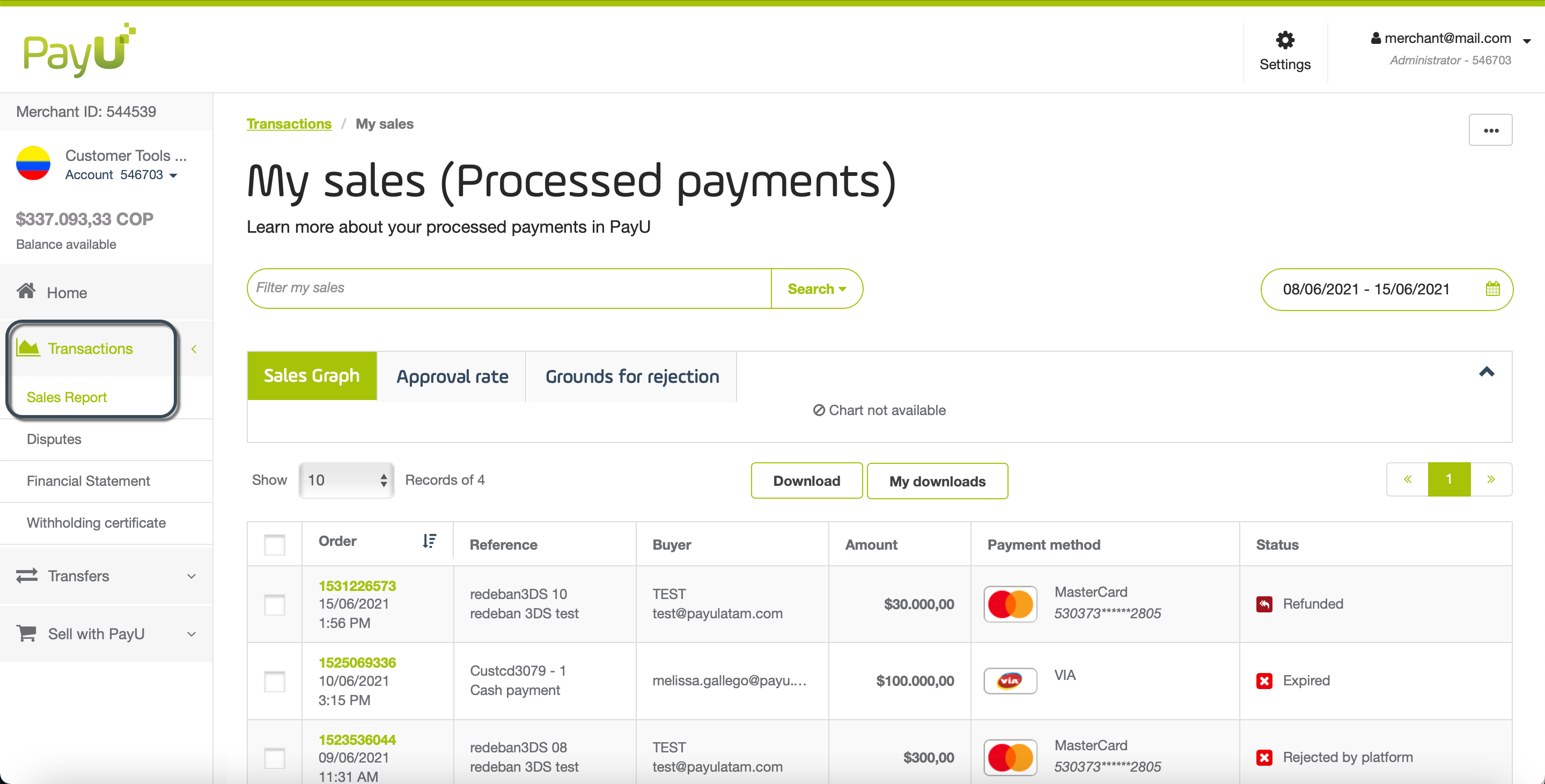

Checking the Status via the PayU Management Panel

-

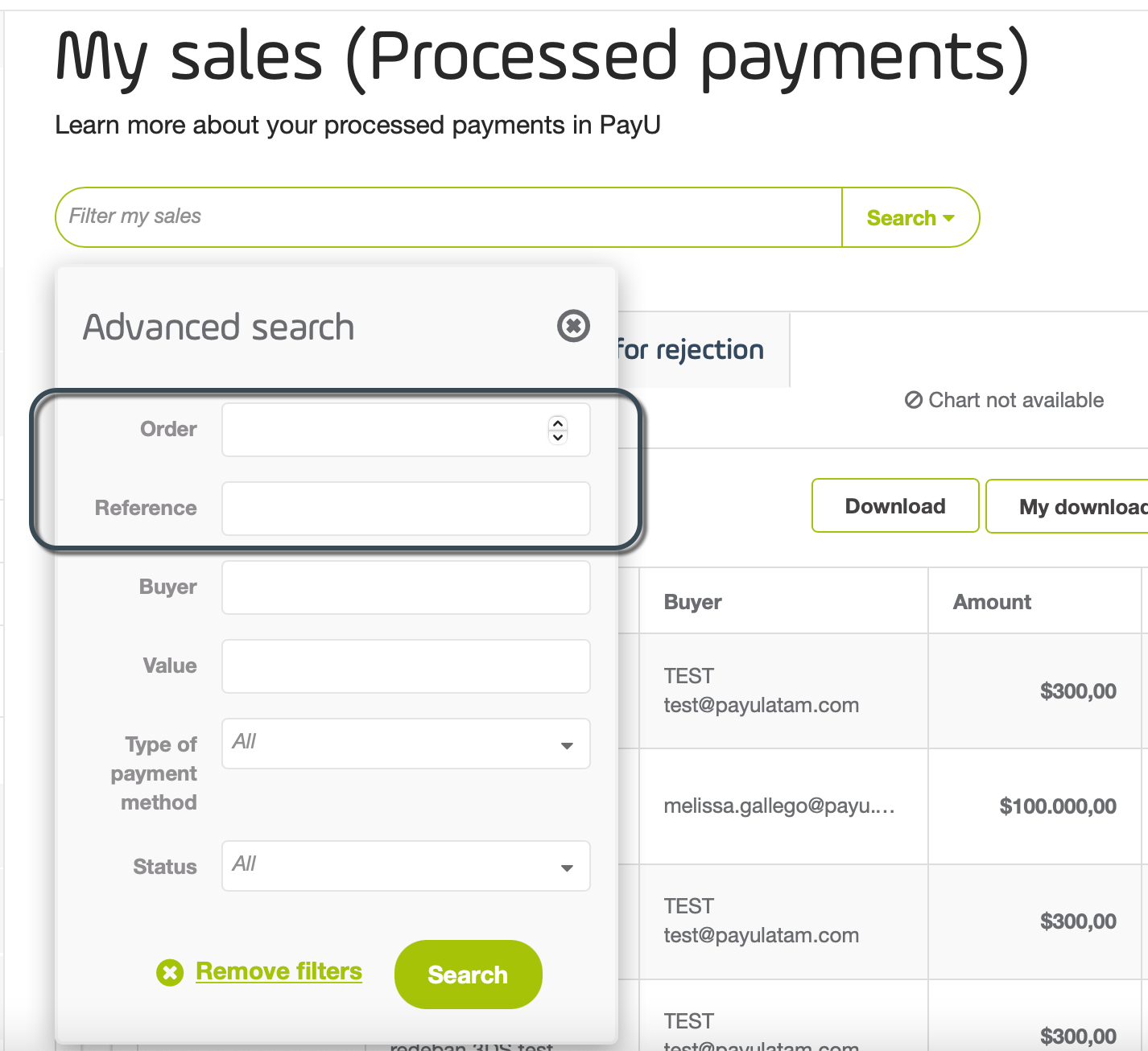

Log in to the PayU Management Panel. In the left menu, expand the Transactions tab and select Sales Report.

-

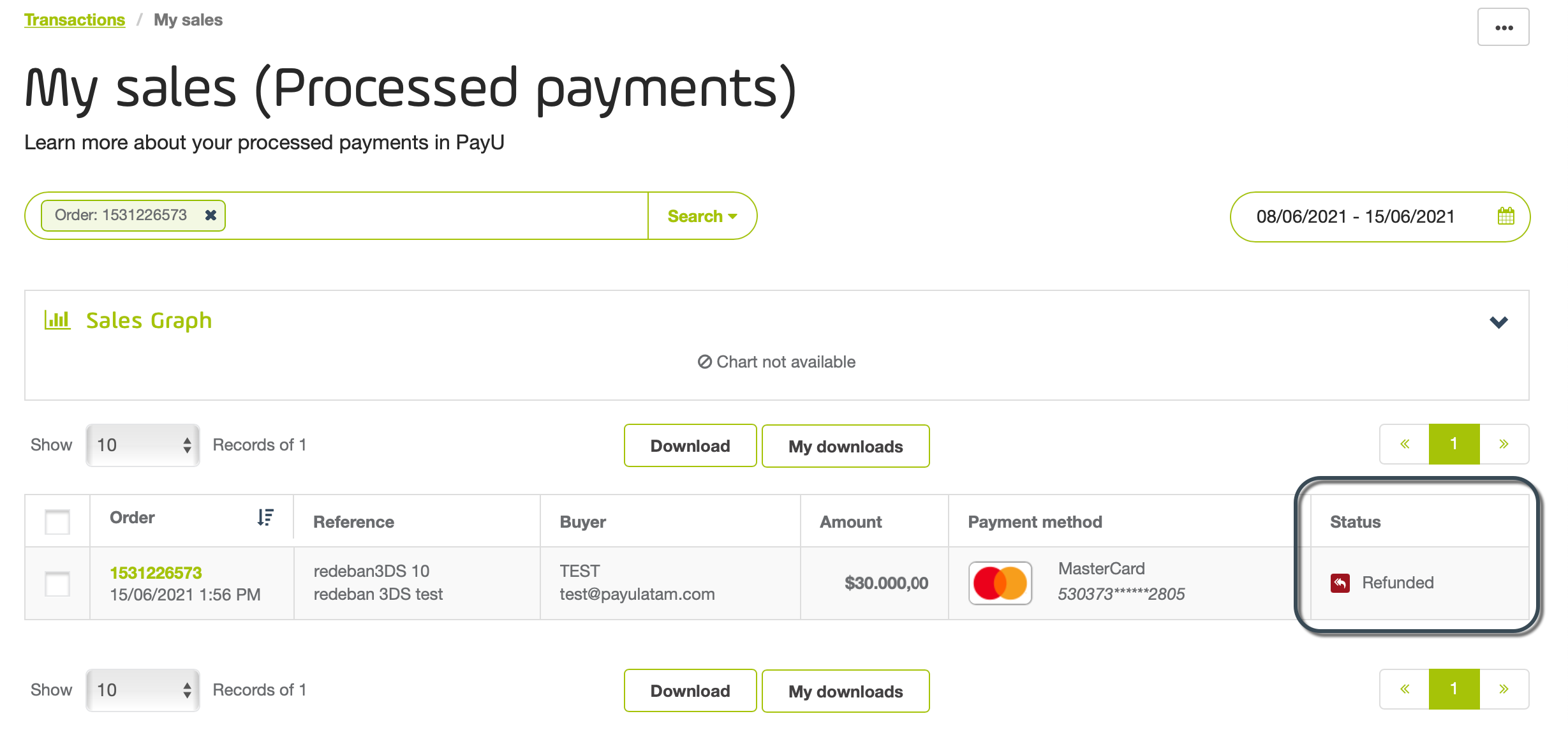

Use the Filter my sales field to search for the order using the order ID or transaction ID.

-

Check the Status column to see whether the refund is approved, rejected, or still pending.

Checking the Status via the Queries API

You can also check the refund status using the Queries API. To do so, send a request with the order ID. When you query an order, the system returns the most recent transaction associated with it.

The response can indicate one of three statuses:

-

Unresolved Request: If the refund request is still under review, the order appears with the status

CAPTURED(result.payload.statusin the response).- There will be a transaction of type

AUTHORIZATION_AND_CAPTURE(result.transactions.typein the response), and the transaction status will beAPPROVED(result.transactions.transactionResponse.statein the response). - If the merchant uses a two-step flow, there will be a transaction of type

AUTHORIZATIONand another of typeCAPTURE, both with the statusAPPROVED.

- There will be a transaction of type

-

Approved: If the refund request is approved, the order appears with the status

REFUNDED(result.payload.statusin the response).- There will be a transaction of type

REFUND(result.transactions.typein the response). - The transaction status is

APPROVED(result.transactions.transactionResponse.statein the response).

Note: If there are partial captures that do not cover the full order amount, the order status will continue to appear as

CAPTURED. - There will be a transaction of type

-

Declined: If the refund request is declined, the order appears with the status

CAPTURED(result.payload.statusin the response).- There will be a transaction of type

REFUND(result.transactions.typein the response). - The transaction status is

DECLINED(result.transactions.transactionResponse.statein the response).

- There will be a transaction of type

Handling Pending Refunds with the PayU Cancellations Module

This section will guide you on how to track the final status of a refund that you initiated through the PayU Cancellations Module, especially when you are relying on the Queries API for updates.

Manual Cancellations Module and Pending Refund Updates

When you request a refund through the Voids and Refunds API, PayU submits the request to the payment network. If the network rejects the refund, PayU initially returns a PENDING status in the paymentResponse.transactionResponse.state field.

In this scenario, PayU automatically activates the Cancellations Module to retry the refund. This process may involve multiple attempts, each generating a new refund ID, until a final status is reached. This mechanism improves refund success rates and reduces the need for merchants to submit multiple manual attempts.

To confirm whether the refund request submitted through the Voids and Refunds API has reached a final status (APPROVED or DECLINED), you should:

- Query its status using the Queries API (by order ID), or

- Wait for a notification via your configured webhook (

notifyUrlfor API integrations or the Confirmation Page for WebCheckout).

Notes

- If you do not want PayU to manage your refunds through the Cancellations Module, contact your account manager to disable this service. In that case, you will always receive the direct network response without PayU retries.

- In many countries, up to 99% of refunds processed via the Cancellations Module are approved. For partial refunds, the approval rate can reach 97%.

Identifying the Final Refund Status in the Queries API

To distinguish between your initial refund request and the attempts generated by the PayU Cancellations Module, use the Order ID or Reference Code in the Queries API and check the following fields:

result > payload > status– General order status (REFUNDEDif the full amount was refunded;CAPTUREDmay indicate partial refunds).result > payload > transactions[] > id– Refund transaction ID.result > payload > transactions[] > type– Transaction type (REFUNDorPARTIAL_REFUND).result > payload > transactions[] > source– Source (EMPTY= online refunds,CANCELLATIONS_MODULE= retries via PayU Cancellations Module).result > payload > transactions[] > transactionResponse > state– Refund status (PENDING,APPROVED,DECLINED).result > payload > transactions[] > transactionResponse > operationDate– Date and time when the refund was generated.result > payload > transactions[] > additionalValues > TX_VALUE > value– Refund amount.result > payload > transactions[] > extraParameters > MANUAL_REFUND– Indicates how the refund was processed (absent,TRUE, orFALSE).

Rules for Updating Refund Status

Follow these rules when updating your system:

MANUAL_REFUND |

Refund status | Meaning | Recommended action |

|---|---|---|---|

| Absent | PENDING |

Initial refund in process | Do not update |

| Absent | DECLINED |

Initial request rejected; Cancellations Module activated | Do not update |

FALSE |

APPROVED |

Refund processed automatically by the Cancellations Module | Update status |

FALSE |

DECLINED |

Refund attempt failed via the Cancellations Module | Do not update |

TRUE |

APPROVED or DECLINED |

Refund finalized via the Cancellations Module | Update status |

Additional Considerations

- If the final status is

DECLINEDafter the Cancellations Module operation, you may submit a new refund request via the Refunds API. When doing so, avoid updating based on previous transaction attempts — useoperationDateandTX_VALUEto track the correct refund attempt. - Always register one refund record per API request in your system, even if the Cancellations Module created multiple transactions.

- Update your refund record only when a final status is reached, following the rules above.

Identifying the Final Refund Status via Webhook

PayU also notifies you of the final refund status through your configured webhook (notifyUrl for API integrations or Confirmation Page for WebCheckout).

Webhook Logic

- If the refund request status is

APPROVEDorDECLINED, PayU immediately sends a webhook notification. - If the refund status is initially

PENDING, no webhook is sent until a final status (APPROVEDorDECLINED) is reached.

Webhook Update Rules

- If the initial status is

PENDING, do not update the refund until you receive the webhook. - Once the webhook arrives, update the refund status accordingly (

APPROVEDorDECLINED). - Use at least the following fields from the payload to identify the refund correctly:

transaction_type– Transaction typevalue– Refund amountresponse_message_pol– Response messagetransaction_date– Date and time of the transaction

Webhook Considerations

Unlike the Queries API, the webhook only notifies you once the refund reaches a final status. No notifications are sent for intermediate attempts (PENDING) or retries within the Cancellations Module.

For this reason, we recommend implementing the webhook if you have not already done so. It allows you to update refund statuses automatically without applying the manual validation rules required for the Queries API.

This behavior applies when the following account settings are enabled:

- Allow reversal transactions with pending state: Off

- Activate pending response for voids and refunds: On