Payouts - Colombia

Payouts is an integration service available under demand, and its activation depends on a security and risk analysis. For more information or requesting this service, contact your Sales Representative.

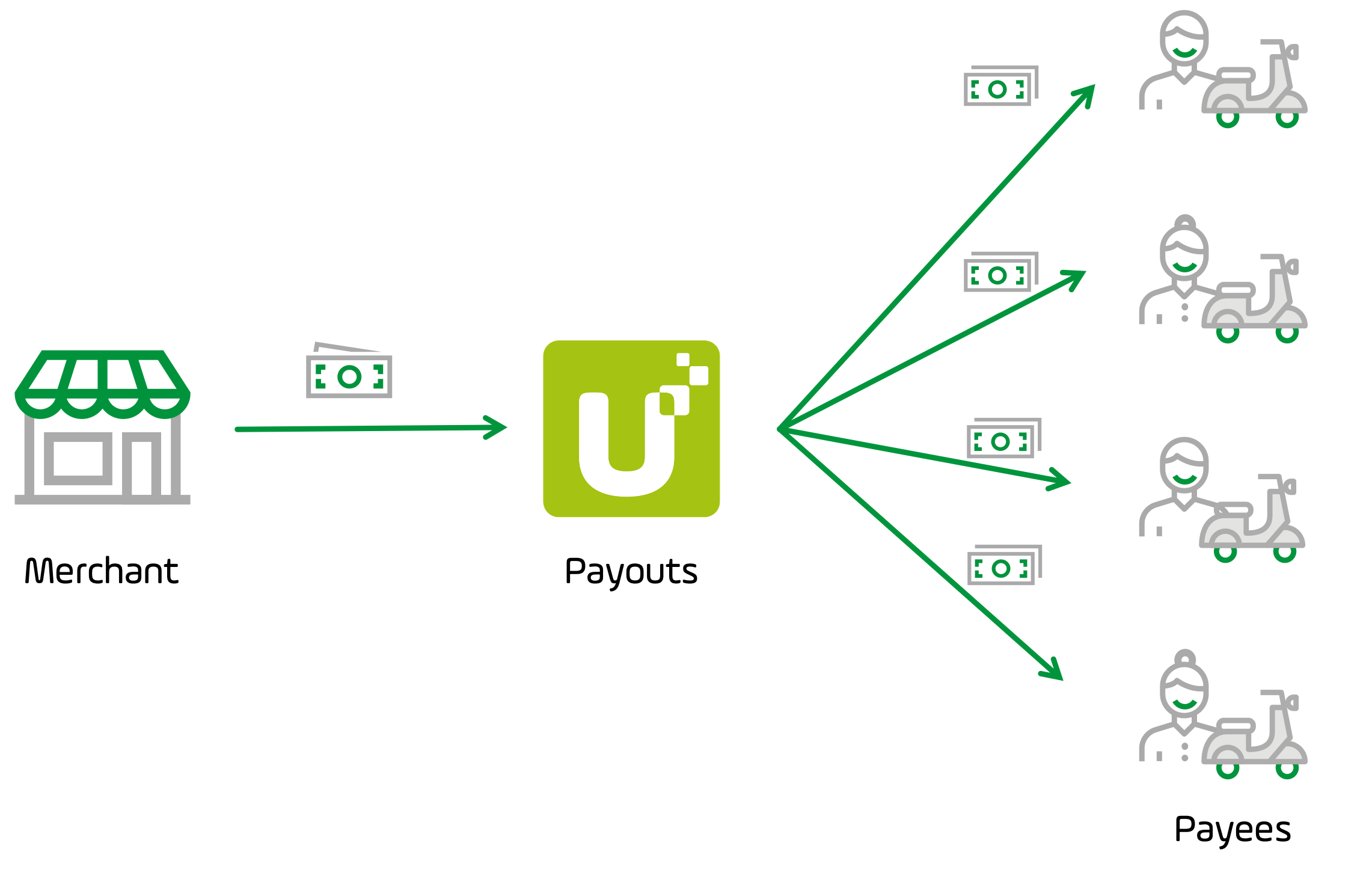

Let’s explain Payouts using an example. A merchant offers products and services available for delivery; this merchant uses PayU as their online payment platform and has an account where they collect the money paid from their customers. This merchant has many couriers to whom, they pay a fixed amount per delivery they made.

Each week, the merchant pays the amount earned to each courier. To do this, they can use Payouts to pay directly from their PayU account instead of managing the payments on their own, in which case, the merchant must transfer the money to their accounts or use funds from other sources.

To request the pay, the merchant sends the list of payees they want to pay along with the amount of each one, PayU validates these payees and schedules the payout.

The amount of each payout plus the processing fee is deducted from your account. Contact your sales representative to know the processing fee to use this service.

Benefits

- Leverage regional capabilities.

A complete and easy-to-use API to make payments to any bank in the processing country*.

*Available for now in Colombia, with other markets coming soon. - One or multiple payouts.

The API is flexible. You can create one or multiple requests which can be new or existing. There is no restriction for the number of records. - Save time and costs.

You can save operational costs and time managing all payment operations in just one place. - Better manage account funds and balance.

You can cancel payment orders before the payout is sent to the bank. Payouts feature helps you to better manage your account funds and balance. - Customizable notifications.

Any changes in the payment order status are updated through our solution. You can customize the update notifications you receive.

How does the Payouts feature work?

Through Payouts, you can send multiple and secure payouts such as fund disbursement to employees, sub-merchants, suppliers or customers, using the funds you have in your PayU Account.

You only need to provide the amount to pay along with the information of each payee (such as name, identification, bank information, etc.), and PayU transfers the requested amount after validations.

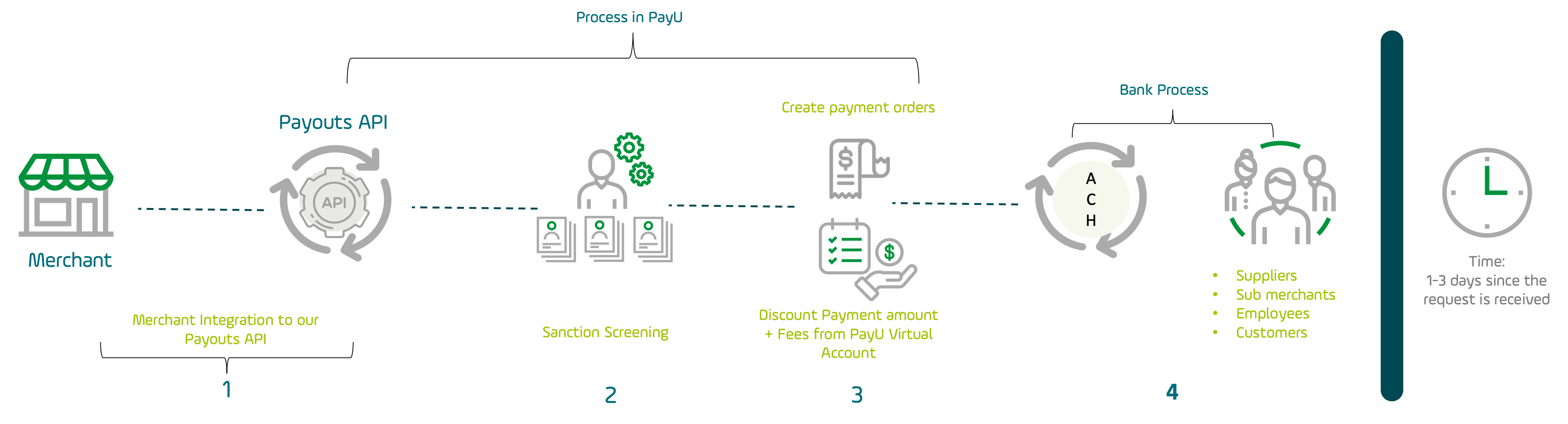

- Payout request: you send an API request with the list of payees you want to send funds to, along with the amount for each transaction and their payment information.

- Payee validation: payees are validated through our solution (Sanction Screening process) and payouts are scheduled.

- Funds deduction: each payout along with the processing fee are deducted from your PayU virtual account.

- Confirmation process: the bank processes the payment according to ACH process. You can customize notifications to receive changes in the payment status.

Payout states

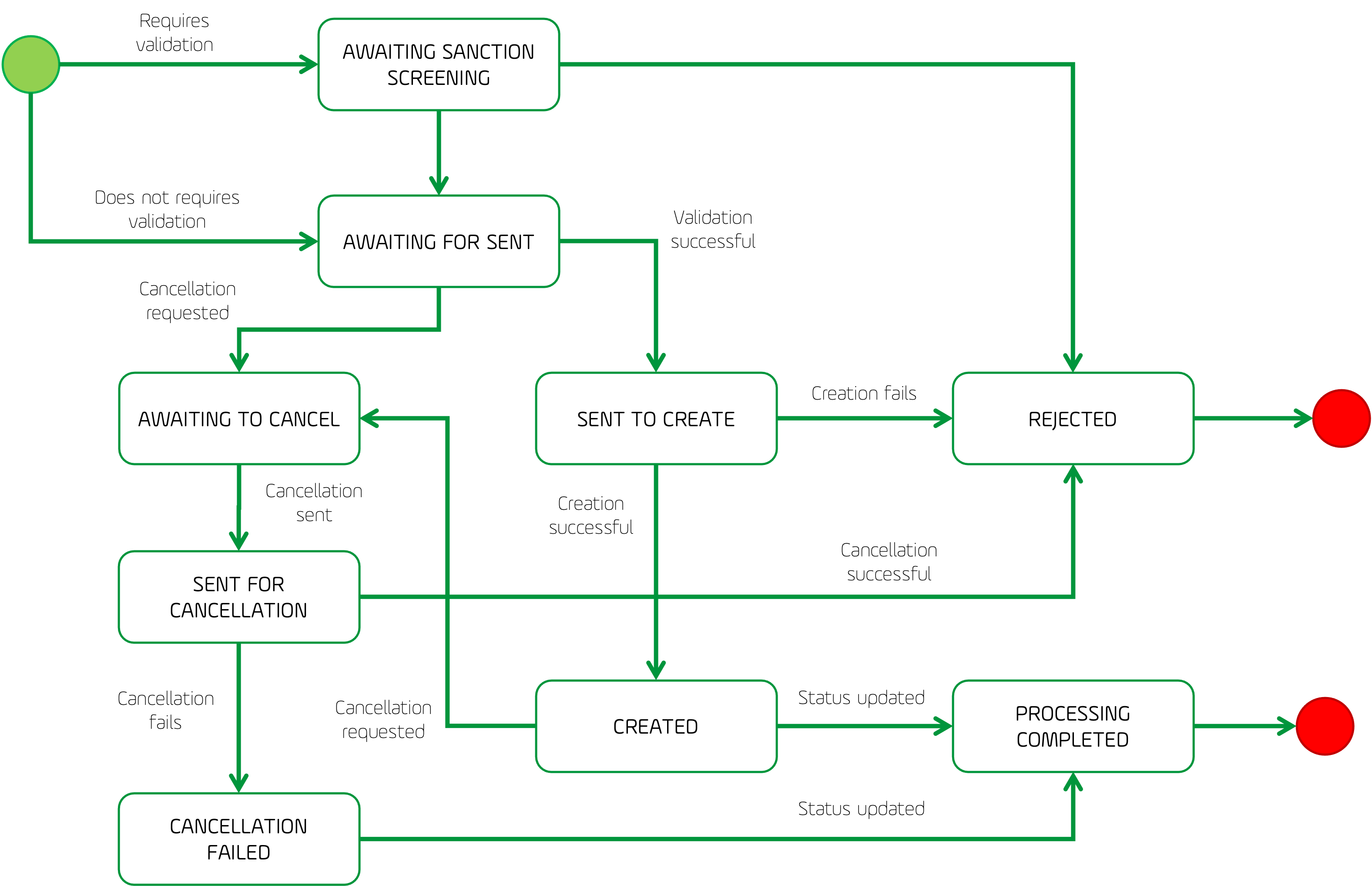

Payouts are performed in two main steps: the first step is when you request the payment to a payee. The second one is when the request has been approved and moves to the transfer of the funds.

The transactional procedure of Payouts has the following states.

- AWAITING SANCTION SCREENING: this state indicates that the payee to whom the payment will be made is subject to validation of restricted lists and further PayU policies related to risk analysis. If a payee does not pass this validation, the payment is automatically rejected.

- AWAITING FOR SENT: if the payee passes the validation or is not subject to it, this state indicates that the request is ready to be processed. In this state, the communication with the service has not been performed.

- SENT TO CREATE: this state indicates that the communication with the service has been completed and the Payout request is in creation process.

- CREATED: this state indicates that the request has been created and has become into a payment order. When the request becomes a payment order, it moves between the states explained in Payment order states. The next state depends on the result of the payment order process.

- REJECTED: this state indicates that the request has been rejected. A request can be rejected when:

- The validation of the payee fails.

- The creation of the payout was failed.

- You request the cancellation of the Payout request and it has been approved.

- PROCESSING COMPLETED: this state indicates that the Payout process has been completed.

- AWAITING TO CANCEL: this state indicates that you have requested the cancellation of a Payout request. Take into account that you can request the cancellation of a Payout request when this is not in Banking process.

In this state, the communication with the service has not been performed. - SENT FOR CANCELLATION: this state indicates that the communication with the service has been completed and the Payout request is in cancellation process.

- CANCELLATION FAILED: this state indicates that the request of cancellation cannot be executed due to PayU policies or because the request is not being processed by PayU.

The following diagram illustrates the state changes:

Payment order states

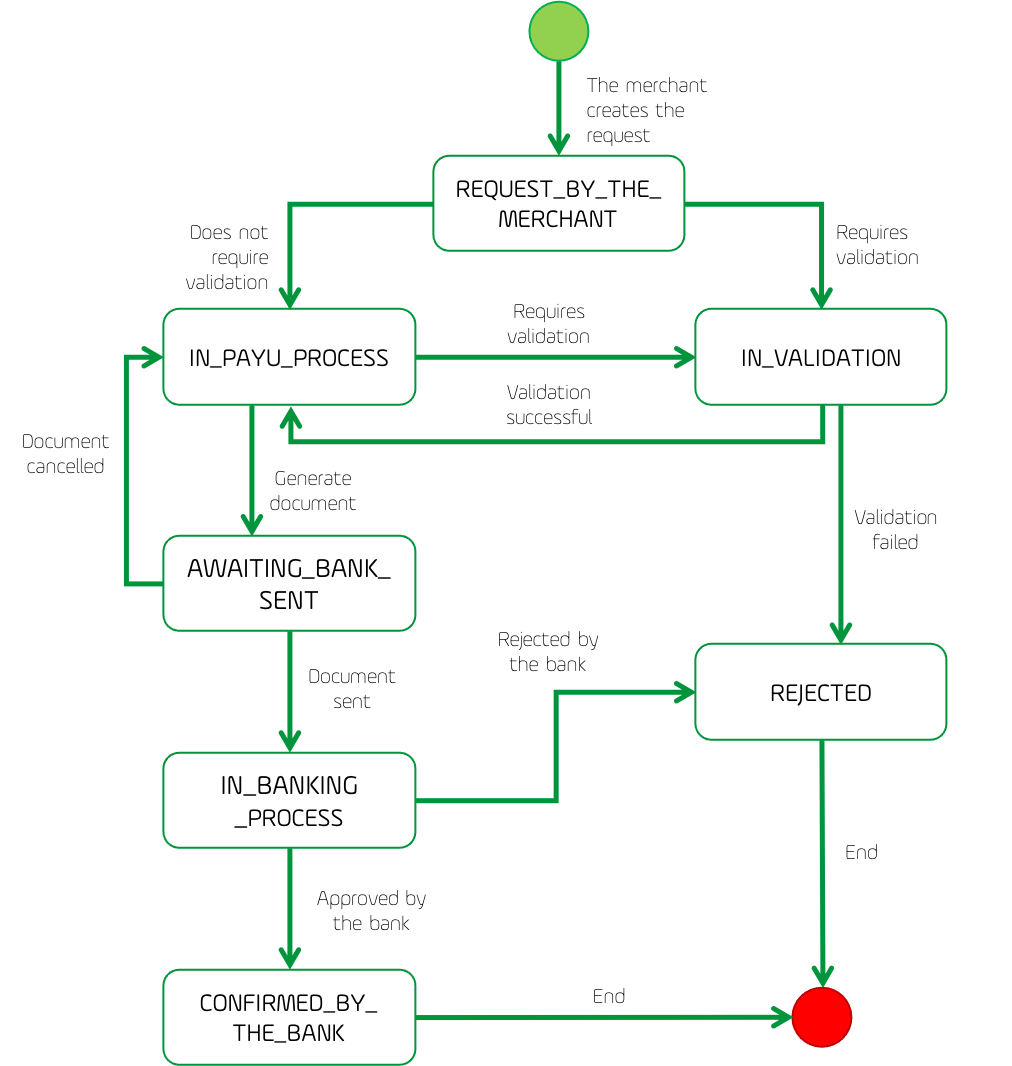

Once the Payout has been approved, it is transformed into a payment order. The following are the states of a payment order.

- REQUEST_BY_THE_MERCHANT: this is the initial state of the transaction, once you send the list of payees to be paid and they are approved, the transaction takes this state.

- IN_VALIDATION: due to PayU policies, each payment may be subject to validation. This state indicates that your request must be reviewed under our internal policies. If the validation fails, the payment which didn’t meet the policies is rejected.

- IN_PAYU_PROCESS: this state indicates that PayU has started the process payment.

- AWAITING_BANK_SENT: this state indicates that PayU has started the transfer of the amount to the payee.

- IN_BANKING_PROCESS: this state indicates that the payment is being processed in the payee’s bank account. At this point you cannot cancel the request.

- CONFIRMED_BY_THE_BANK: this state indicates that the payee has received the transferred amount.

- REJECTED: this state indicates that the transaction has been rejected either by PayU (due to policy breach) or the Bank (due to errors in the bank information).

The following diagram illustrates the state changes:

Transaction validation

Every Payout request is validated to verify that the person who will receive the money is not included in restricted lists. This validation may take up to 24 hours which may delay the payment procedure.

When a person must be verified, PayU checks first in the validation cache, so a person is only validated once during the cache frame.

If a person does not approve the validation, the Payout is not performed and you are notified if you have configured the notifications of validation results.

Considerations

Take into account the following considerations:

- Payouts is not a service included by default. You must request it and sign an annex to the contract to agree the fee and further conditions. Contact your Key Account Manager to contract this service.

- Merchants are responsible for the integrity and the correctness of the payee’s data. PayU does not validate that the data provided by the merchant is complete and correct.

PayU is not responsible for unsuccessful transactions due to wrong data. - Payouts allows local payments only. The merchant may be international (under security and risk analysis) but they can only request payouts using the funds collected in the processing country.

For example, if the merchant ABC processes in Colombia and Peru, they can request payouts to payees in Colombia using the funds collected in Colombia; they cannot request payouts to payees in Peru using the funds collected in Colombia. - Once the payout is created, it takes the regular flow in PayU. This means that you can see the payout created in your PayU module.

- The merchant must prove the relationship between them and their payees to guarantee that the transaction is legit.

- Payouts for Daviplata accounts are not supported.

Transaction processing

Payouts uses ACH (Automated Clearing House) transfers to send the payouts to the beneficiaries, this means that the transactions are processed in batch during the day. The time when the transaction will be processed is explained in the following table:

| IN_BANKING_PROCESS state time | ACH process time | Estimated time of response |

|---|---|---|

| 05:31 p.m. - 07:20 a.m. | 9:00 a.m. | 7:55 p.m. |

| 07:21 a.m. - 09:45 a.m. | 11:30 a.m. | 10:40 a.m. Next working day. |

| 09:46 a.m. - 12:30 p.m. | 2:00 p.m. | 1:45 p.m. Next working day. |

| 12:31 p.m. - 02:50 p.m. | 4:00 p.m. | 4:40 p.m. Next working day. |

| 02:59 p.m. - 04:20 p.m. | 6:00 p.m. | 6:20 p.m. Next working day. |

Transactions that reaches IN_BANKING_PROCESS state after 4:20 p.m. will be processed in the next working day.

Note

Payout requests may not be in IN_BANKING_PROCESS state after you sent them, and depending on the validation of the beneficiary, it may take up to 24 hours.Notifications

When using Payouts, you can create a WebHook to configure notifications on status changes. It is recommended to configure the WebHook before sending the Payout request when configuring notifications.

You can configure a WebHook for one or more of the following events:

- Transfer creation: sends a notification when a payout request is created.

- Transfer update: sends a notification when the sanction screening validation rejects the payee.

- Validation result: sends a notification when the payee has approved the sanction screening validation and when the transfer has been rejected by the bank.

To learn how to create WebHooks, refer to this article.

Variables in the notifications

The following variables are sent to the WebHook when any of the events explained before occurs.

| Variable | Format | Description |

|---|---|---|

pushPaymentId |

Alphanumeric | Id of the payout created. |

creationDate |

Numeric | Date when the payout was created. This date is in milliseconds. |

value |

Numeric | Amount requested to be transferred to the payee. |

currency |

Alphanumeric | Currency of the amount requested. |

state |

Alphanumeric | Current Payout state. |

status |

Alphanumeric | Current Payment order state. |

errorCode |

Alphanumeric | Error generated after the sanction screening validation. |

errorMessage |

Alphanumeric | Error message generated after the sanction screening validation. |

supplierBankAccountId |

Alphanumeric | Id of the payee’s bank account generated by the payout request. |

fullName |

Alphanumeric | Name of the payee of the payout. |

documentNumber |

Numeric | Document number of the payee of the payout. |

country |

Alphanumeric | Country of the payee of the payout. |

validationState |

Alphanumeric | Result of the validation performed by PayU. |

dateOfTheNextValidation |

Numeric | Date when the payee will be validated by sanction screening. This date is in milliseconds. |

What’s next?

The integration with this feature fo is performed using API integrations.